Preview of full Precious Metals Bullion Insights Report

To receive the full report of our Precious Metals Bullion Insights on the first working day of each week, please subscribe here:

(We promise there will be no spam but informative insights from our in-house technical analyst team!)

[gravityform id=”3″ title=”true” description=”true”]

PRECIOUS METALS MARKET REVIEW.

| Weekly Spot Price (14 August – 18 August 2017) | ||||

| Open | High | Low | Close | |

| Gold | 1289.85 | 1300.61 | 1267.06 | 1284.1 |

| Silver | 17.07 | 17.27 | 16.53 | 16.93 |

| Platinum | 984.08 | 987.81 | 950.43 | 976.58 |

Precious Metals News Updates:

| · | Gold trades little changed as investors focus on geopolitics, central bank meet. Gold prices were little changed on Monday as investors sought further direction after a week of geopolitical uncertainty in the United States and Europe and ahead of a meeting of central bankers later this week. | ||

| · | All that glitters is profit in China’s gold mines as demand for safe haven boost precious metal sales. Hedging demand triggered by political uncertainty became the main driver of the periodical increases in gold price. | ||

Economic figures to monitor this week:

| Day & Date | Economic Events |

| Wednesday, 23 August 2017 | ECB President Draghi Speaks

New Home Sales (Jul) (US) Crude Oil Inventories |

| Thursday, 24 August 2017 | GDP (QoQ) (Q2) (UK)

Existing Home Sales (Jul) (US) |

| Friday, 25 August 2017 | Core Durable Goods Orders (MoM) (Jul) (US)

Fed Chair Yellen Speaks |

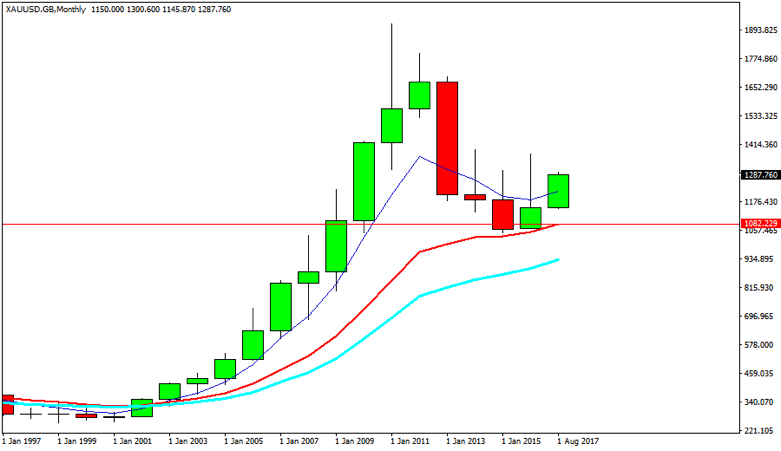

TECHNICAL ANALYSIS.

NOTE:

In Non-Trending Mode markets (aka range trading markets), CCI directional Indicators have statistically demonstrated a higher correlation to market direction. Additionally, we overlay the CCIs in a format that further reveals the market cyclical structure and thus enhances market analysis.

COMMITMENT OF TRADERS REPORT (ANALYSIS)

Reportable positions as of 15/8/2017,

| Commitment of Traders Report | |||||||||

| Commercial | Non Commercial | ||||||||

|

Producer/Merchant /Processor/User |

Swap Dealers | Managed

Money |

Other

Reportables |

Non Reportable Positions |

|||||

| Long | Short | Long | Short | Long | Short | Long | Short | Long | Short |

| 32,943 | 191,174 | 71,922 | 114,046 | 196,453 | 16,916 | 80,313 | 68,019 | 44,294 | 35,769 |

| Changes in commitments from 8/8/2017 | |||||||||

| -424 | +13,652 | -2,380 | +23,283 | +29,385 | -11,586 | +3,188 | +2,170 | -23 | +2,227 |

OUR TAKE:

Commercials continued to decrease their long positions while increasing their shorts positions by -424 contracts and 13,652 contracts respectively during the period of 8/8/2017 to 15/8/2017. Gold rallied 2% to reach the 1290 level, a level last seen in June. This is the first time in 4 weeks that Commercials increased their shorts position significantly. The last time this happened, Gold rallied as well.

(Focus is only on the Producer/Merchant/Processor/User as they are hedgers and Gold producers. Non Commercials refer to CTAs and fund managers who trade (speculate) professionally. Commercial hedgers usually hold an edge over the speculators in the long run due to their “stronger hand” advantage and are usually reliable indicators of trend changes)

Call us at 6222 9703 or email at bullioninsights@goldsilvercentral.com.sg to discuss with us how to further interpret the data.