We are a Singapore registered company that specialises in physical bullion trading in Gold, Silver and Platinum at real-time pricing, completed with a whole array of services.

+65 6222 9703 | Mon to Fri: 10am to 5.45pm | Sat: 10am to 12.45pm

Email: enquiry@goldsilvercentral.com.sg

GoldSilver Central Pte. Ltd.

3 Pickering Street #01-15/16 Nankin Row Singapore 048660

General Questions

You can set up your Price Alerts for the product you are monitoring! Here's how you can do it:

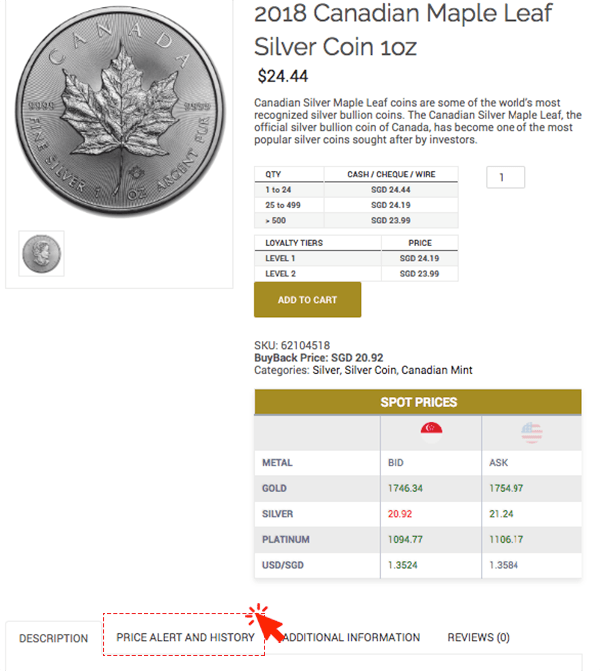

Step 1: In a Single Product Page, scroll down to the multiple tabs area and click on "PRICE ALERT AND HISTORY":

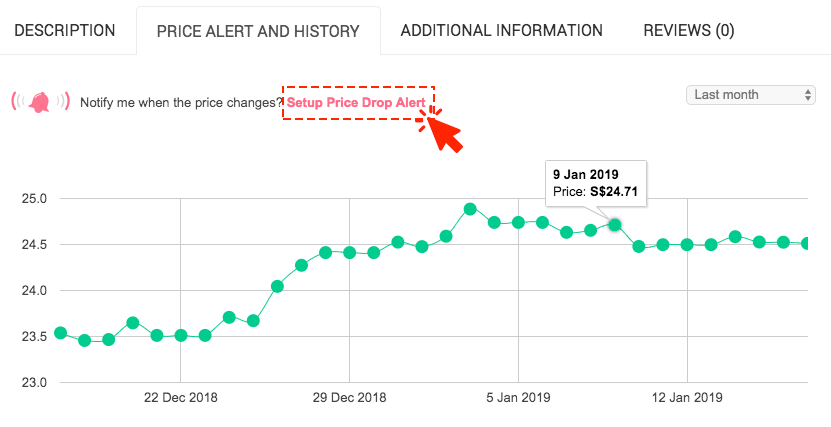

You will see the Price History of the product in a chart

Step 2: Click on "Setup Price Alert" as highlighted in this screenshot:

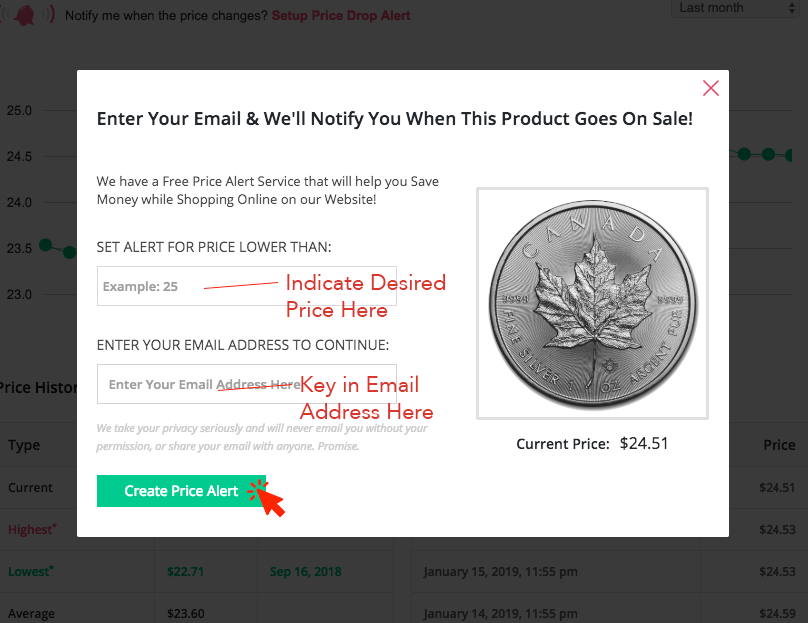

Step 3: You will see a pop up to key in your price and email. Key in your desired price and your email in the highlighted fields and click on "Create Price Alert" Button:

Step 4: You will get a confirmation pop-up and receive an email once the price drops to your indicated price.

No, there is no minimum quantity or weight needed before you place an order with GoldSilver Central (GSC).

Yes, there is a maximum amount of both gold and silver that you can order online which is $9000. For orders above these amounts, please contact GSC to speak with one of our staff or purchase it in our office during office hours.

Prices are based on a live market spot price hence there is a possibility that the bullion price has increased. Prices will only be locked in when you confirm your order.

Under the Tourist Refund Scheme, if your purchases with us amount to more than S$100 (including GST), you can claim a GST refund on the 7% Goods and Service Tax (GST) paid (up to 3 same day receipts).

We will need your passport to process the ticket for your claim.

However, you will not receive the full 7% refund as the GST refund providers will charge a service fee. Most of the time you will be able to receive about 6.2% of the purchased value back.

The following criterias must be met:

- You are not a Singapore Citizen or Permanent Resident;

- You are aged 16 and above at the time of purchase;

- You are not a crew member of the aircraft on which you are leaving Singapore by;

- You are leaving Singapore from Changi Airport or Seletar Airport. You will not be eligible for a GST refund if you are leaving by the Causeway of Sea;

- You must have made your purchases within two months from when you apply for a refund and

- You are not a Specified Person

i. on the date of the purchase;

ii. at any time within the period of 3 months immediately before the date of purchase; or

iii. on the date you submit your claim for a refund of the GST charged on your purchases at the airport;

Can I cancel an order after I have submitted the order?

All sales are final. They are not cancellable, refundable or returnable. In the rare event that GSC approves the cancellation of the order, the customer will be subjected to our market loss policy which states that:

Once an order is submitted and a confirmation number (invoice number) is given, the transaction is valid and it may not be cancelled unless the individual is willing to bear the difference in the ask price based on our current ask price, if any, and an additional SGD$50.00 cancellation fee which is subjected to GST.

Any market gain in price will not be refunded.

There is a admin fee of SGD$50.

Once an order is submitted and a confirmation number is given, the transaction is valid and it may not be cancelled unless the individual is willing to bear the difference in the ask price based on our current ask price, if any, and an additional SGD$50.00 cancellation fee.

Any market gain in price will not be refunded.

How much I can expect to pay for my local order shipping charges?

We offer a comprehensive local door to door delivery service with complementary 100% insurance coverage, giving customers peace of mind while transacting with us.

Local shipping charges:

Purchase value $SGD. Estimated shipping charges $SGD.

50 to 1000 6-25

1000 to 2000 25-38

2000 to 3000 38-46

3000 to 4000 46-48

4000 to 7499 48-55

*Enjoy FREE delivery to your doorstep for orders above S$7500.00*.

Contact us for your delivery needs, and we will be happy to assist!

Can you ship gold or silver to us if we are foreigners and reside overseas?

We are able to ship gold and silver abroad, however at additional shipping and insurance cost. Please note that full payments have to reach us via telegraphic bank transfer within 30 minutes before we will ship the bullion out.

Please call us to enquire as we also do have gold and silver stocks in a bonded warehouse. This allows you to purchase gold and silver without the goods and services tax if you reside overseas or have a bonded warehouse in Singapore.

Can I make a purchase and collect it later?

Collection can be made anytime after the order has been paid for. Please inform us at least one business day in advance before collection.

Once the order is made, the full payment has to be wired to us within 30 minutes.

We do accept orders placed from a foreign address. However, please take note of the following details:

- We cannot accept Credit Card (overseas card) online currently, hence payments need to be done via a bank transfer or Telegraphic Transfer (TT)

- Should you not be able to pick up the items in Singapore, there would be a delivery charge for International Shipping in which our team will advise you on

For purchases on GST Exempted Gold, Silver and Platinum Coins and Bars, we would require the customer's Name and Address on the invoice. This is a requirement set by IRAS (Inland Revenue Authority of Singapore) under the Invoicing Requirement for an exempt supply of IPM.

REGARDING PAYMENT

GoldSilver Central's accepted payment mode:

1) Cash payment on collection in SGD (For Clients who have USD notes, we do recommend clients to change their USD to SGD at money changers before dropping us a visit as they would provide better and more competitive rates)

2) Cashier's cheque*

3) Personal Cheque deposit in either SGD or USD (Please cross your cheque and write the invoice number on the reverse side, Please also make it payable to GoldSilver Central Pte Ltd)

4 ) Bank Transfer

Bank Transfers are processed within our Operating Hours (Monday to Friday: 10am to 5.45pm. Saturday: 10am to 12.45pm). Transfers done outside of our Operating Hours will only be processed on the next business day.

Here are the bank account details:

FOR PAYMENT IN SGD:

UOB SGD Current Account

Bank Name: United Overseas Bank

Singapore

Name of Branch: Head Office

Bank code: 7375

Branch code: 001

Bank Swift code: UOVBSGSG

Account Number: 433-366-0274

Account Name: GoldSilver Central Pte Ltd

DBS SGD Current Account

Bank Name: DBS Bank Ltd

Name of Branch: South Bridge Branch

Bank code: 7171

Branch code: 010

Bank Swift code: DBSSSGSG

Account Number: 010-903558-3

Account Name: GoldSilver Central Pte Ltd

FOR PAYMENT IN USD:

UOB USD Account

Bank Name: United Overseas Bank Singapore

Name of Branch: Head Office

Bank code: 7375

Branch code: 001

Bank Swift code: UOVBSGSG

Account Number: 352-930-242-6

Account Name: GoldSilver Central Pte Ltd

DBS USD Current Account

Bank Name: DBS Bank Ltd

Name of Branch: South Bridge

Bank code: 7171

Branch code: 010

Bank Swift code: DBSSSGSG

Account Number: 0010-002901-01-1

Account Name: GoldSilver Central Pte Ltd

We do require 2 business days for Telegraphic Transfers.

*Please take note that the time taken to check for transactions done on Saturdays might take longer and we do advise clients to make payments before Saturday where applicable.

5) Credit Cards

For Credit Cards, we accept

- VISA, MASTERCARD (note that surcharge is applicable)

6) Alipay (note that surcharge is applicable)

7) FOMO Pay (note that surcharge is applicable)

8) NETS (note that surcharge is applicable)

9) Citibank Credit Card 0% Interest-Free Instalment Plan

Citibank Credit Card Singapore Holders can choose to pay for their Gold, Silver and Platinum purchases via a 6-month, 12-month or 24-month interest-free instalment plan* at our retail store.

All you have to do is inform us at our retail store that you would like to opt for the 0% Instalment Payment Plan and charge your Gold, Silver or Platinum purchases to your Singapore-Issued Citibank Credit Card (for VISA and MasterCard Only).

Please note that there will be a 1-time Processing Fee charged as followed:

6-months - 2.65%

12-months - 3.65%

24-months - 4.65%

Cards must be Citibank Issued Cards. Citibank Issued Debit or ATMS Cards are not applicable for this 0% Interest-Free Instalment Plan. The minimum spending amount required for the Instalment Plan is S$500.00.

Terms and Conditions Apply.

10) PayNow

- Log into your Bank's existing Internet Banking Platform/ Mobile Banking app. (For each bank's instructions on using PayNow, you can click on your bank's icon above to be directed to their designated PayNow information page)

- At PayNow transfer screen, you can either scan the GoldSilver Central PayNow QR Code or choose Unique Entity Number and key in our UEN: 201107187N.

- Key in the Amount to be transferred.

- Confirm that the recipient of the funds is GoldSilver Central, and send the money. It will be transferred almost instantly.

- The status of your transfer will be shown in your existing Internet Banking Platform/ Mobile Banking app.

Payment must be made within 30 minutes after you have received an order confirmation email from GSC. Payment details will be sent to you via email upon order confirmation. Payment not made within 30 minutes may be cancelled without notice and the customer will be subjected to our market loss policy including an admin fee of $50.

Note: GSC reserves the right to refuse or cancel any order in the event that GSC is unable for whatsoever reason to procure any or adequate bullion to satisfy your order, or if customer payment is not received within the Payment Timeframe specified, or when the confirmed price is incorrect, whether due to computer-related problems or otherwise, pricing error or sudden movements in the precious metals market or export/import restriction. Furthermore, we reserve the right to refuse or cancel any order deemed questionable, suspicious or of significant risk to GSC regardless of payment method and price confirmation.

GST is included in the final prices only for bullion that is not stated under the exemption list provided by the Singapore government. Most of the bullion GSC carries are GST exempted. Only bullion that has GST pricing on our website still has GST on it. Please visit this link to read more about the circular released by the Singapore government. Guide on Exemption of Investment Precious Metals - IRAS

GSC will need at least an estimated 10% of the amount of the bullion you are about to order as a deposit before you may place an order online with us for fix a price with us over the phone.

Orders placed with a deposit has to be fully paid up and collected within 3 weeks from the time the order is fixed.

GSC will require at least an estimated 10% of the amount of the bullion you are about to order as a deposit before you may place an order online with us or fix a price with us over the phone.

Once an order is placed online, please arrange for payment to be made and provide us with the screenshot proof. We will also contact you to follow up on any questions you might have.

Orders placed with a deposit will also need to be fully settled as per normal procedures, unless explicitly mentioned and agreed by GSC.

CASH TRANSACTIONS ABOVE SGD 20,000

From 15th October 2014 onwards, customer with cash payment of S$20,000 and above (or its equivalent in a foreign currency) regardless of the number of transaction within 24 hrs will be bounded by the act and is required to provide the information and documents required.

- full name, including any alias used;

- date of birth, for an individual,

- address, which shall be ––

- for an individual, the address of the individual’s usual place of residence; or

- for a body corporate or unincorporated, the address of its principal place of business or office;

- contact number(s);

- nationality, for an individual, or place of incorporation, for a body corporate or unincorporated;

- identification number, which shall be

- for an individual, an identity card number, a passport number, a taxpayer identification number, or the number in any other document of identity issued by a government as evidence of the individual’s nationality or residence and bearing a photograph of the individual; or

- for a body corporate or unincorporated, a registration number, or the number of any other document issued by any government certifying the incorporation, registration or existence of the body corporate or unincorporated;

- the type of identifying document referred to in paragraph (f) and the expiry date, if any, of the identifying document

- occupation, for an individual, or business, for a body corporate or unincorporated.

PRICE FIXING

You may follow the steps below:

1. Let us know which item are you looking to buy and quantity

2. We will calculate 50% advance payment base on current indicative price

3. Upon receiving the fund, we will call you to price fix over the phone base on latest prices at that moment

4. We will issue an order base on the fixed price details, you will receive an order confirmation email

5. Upon receiving the order confirmation, please fully settle the outstanding balance within 2 business days

6. We can safe keep your order for free up to 2 months. We will send photo of your items to you

STORAGE

Your storage holdings are 100% insured as long as they have been handed over to GSC in the proper manner, either at our retail office or directly at the vault. In the event of any discrepancy with your items, GSC will contact you immediately and liaise with our insurance provider to do the necessary claims.

Yes, your holdings are 100% insured as long as they are in our Storage Vaults. For clients who wish to arrange for delivery, a separate insurance(Fully insured) kicks in the moment the delivery crew sign for the items. The insurance fee is already included in your monthly storage fees.

Arrange to have your precious metals deposited at our retail office or directly at the vaults. One of GSC staff will be on site to inspect and sign for your holdings.

At this point, your 100% full coverage insurance kicks in.

Depending on the situation above, we will arrange for the items to be stored directly at the vault or delivery to the vault.

Once the items have been stored securely, GSC will issue an original certificate of ownership to you for your holdings.

Clients who purchase their precious metals from GoldSilver Central have 3 forms of documentation to assert their legal ownership of their stored physical precious metals

1. Purchase Invoices Records

2. Bullion Storage Agreement

3. Certificate of Ownership

Clients will receive their holdings on a monthly basis

Yes, we conduct a mandatory annual on site audit as well as random inspections throughout the year. This is in addition to the audits that our vault operators conduct. Due to security purposes, we will not divulge the frequency or logic process for the frequency of our audits.

Yes, you most certainly can. In fact, GSC strongly encourages you to head down for the first time your items are deposited so you will have a first-hand understanding of the whole process and to evaluate the security of the vault themselves. So far, our clients have been pleased.

Claimants would have to establish that , This will be a legal issue and it would depend on the legal laws in each country. Bear in mind that GSC is a Singapore Registered Private Limited, hence we will be in no legal position to advice.

Yes you may. Part of having a LBMA vault operator as one of our partners connects us (and by extension our clients) to the whole international network of LBMA approved vaults. Contact us to find out more.

As we highlighted above, we conduct annual audits and random inspections throughout the year. Account Holders would also receive monthly statements, and they may schedule vault visits also.

Yes, every bar and coin(If applicable) has their serial number recorded in our system and the vault operator's system.

When your holdings are first received by GSC staff, we will inspect and verify the items as per the client's records. Upon receipt by the vault operator, they will place your items into serialized tamper-proof Seal Bags. The bags' serial numbers will thereafter be printed on clients' Storage Certificates.

Account Holders would need to sign a Release Form and send it for verification first before acting on their holdings.

You may place your holdings on our proprietary GSC Live! platform where you can set automated selling limits for your holdings. The whole process is fuss free, and you may contact our team here to do so.

Alternatively, if Account Holders prefer, they may also choose to phone in during office hours for a phone price fix with our traders.

Due to security and insurance reasons, the delivery crew do not allow passengers to ride with them. However, you are invited to follow along in a separate vehicle if you wish to.

The vault is maintained by an independent LBMA vault operator. When a GSC staff enters the vault, they are accompanied everywhere by a vault operator and the same security protocols apply to them as well. Any withdrawal of holdings also has to be pre-signed by at least 2 company directors at all times, without which no withdrawals will be allowed.

Click here to refer to article

Yes, your holdings continue to be stored on-site in Singapore Le-Freeport and there are no changes to our Storage Vaults.

Yes, the operations at Le Freeport continues as per normal.

Yes, our Vault Partners are physically operational during the month of April and continue to remain so. Note that we have temporarily disabled vault visits during the month of April and will resume vault visits from 4th May 2020 onwards.

Yes, you may do so.

Yes, clients may continue to do so. For online purchases, they may select the "For Storage" option.

For clients who are transferring bullion to us, you may reach out to us to arrange for a Delivery service.

Clients may refer to our payment methods webpage here.

No changes whatsoever.

If you have any questions

Plese do reach out to Jason or our Storage Team via the following:

Jason.ang@goldsilvercentral.com.sg / storage@goldsilvercentral.com.sg

COLLATERAL LOAN

Yes you may continue to do so as per usual.

As our Collateral Loan partner is not listed on the essential services list, their physical premises will remain shut during this period. Clients' collateral loans will only be renewed after 4th of May. However, they will still be in effect, meaning ownership of the precious metals still belong to our Clients. GSC will remind you to pay any outstanding interest so that your collateral loan functions as per normal.

You should have received our Collateral Loan partner's SSI document. If you require a copy, do send us an email at enquiry@goldsilvercentral.com.sg.

Yes, please reach out to us for the relevant processes.

You may arrange via bank transfer payment method. Please note that payments should be made directly to our Collateral Loan partner, and not to GSC.

New Collateral loans will be suspended temporarily.

Once business operations normalize after the 4th May 2020, physical premises will be open and you may arrange for collection then.

There will be no penalties.

As of now, no. GSC will continue to update our clients accordingly.

CLIENT ORDERS WITH GSC

Your items have already been packed and allocated aside. However, they will not be available for collection as GSC's retail front will be closed from 7th April 2020 to 4th May 2020. They will be available for collection after 4th May 2020.

No. there will be no penalties. We aim to value add to our clients and will not take advantage of the current situation.