GSC 10AM REFERENCE PRICES

|

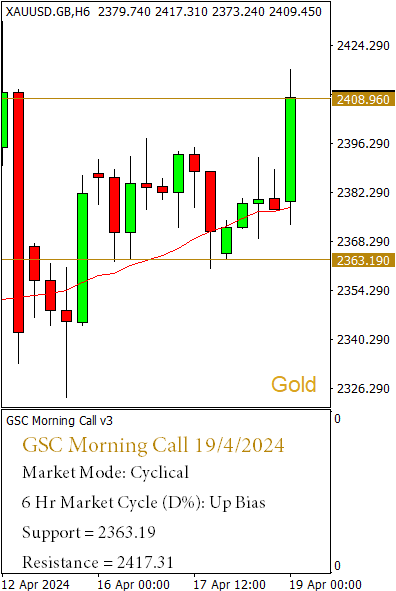

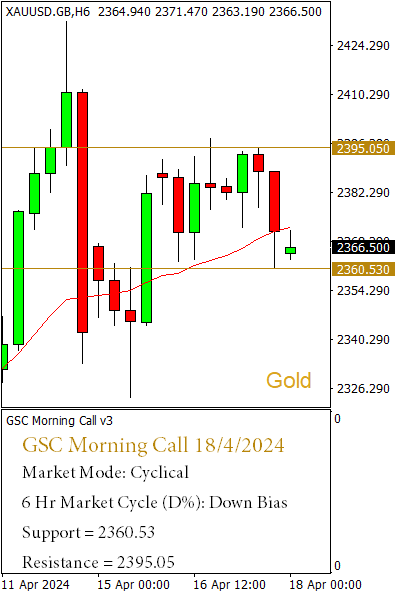

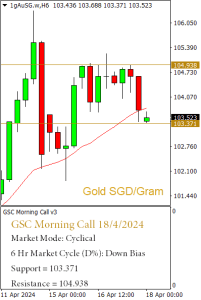

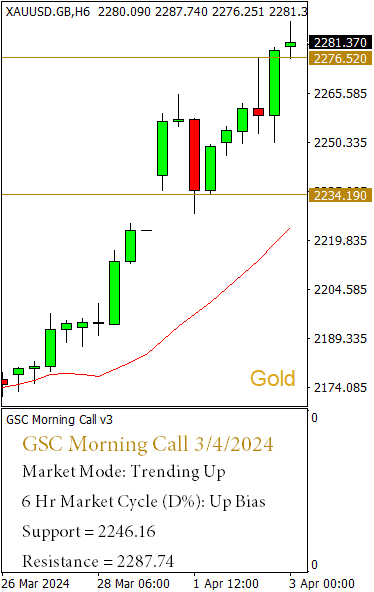

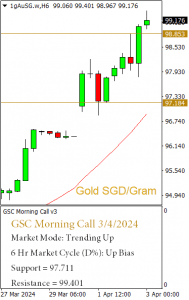

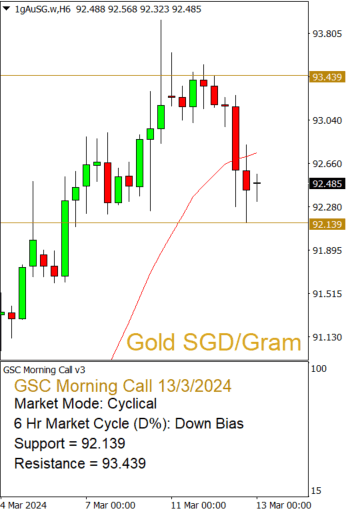

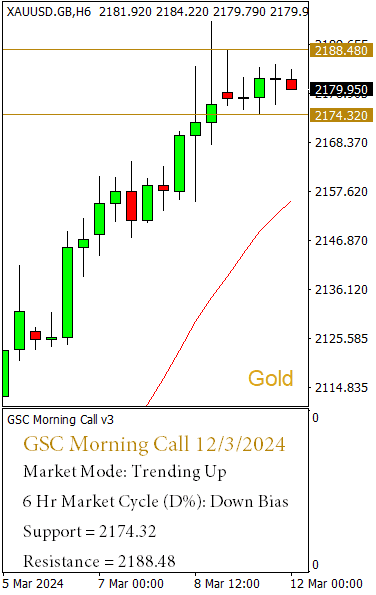

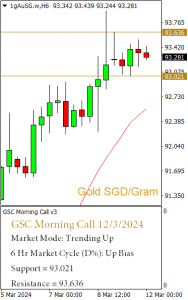

GOLD 1 OZ: SGD 3140.31

|

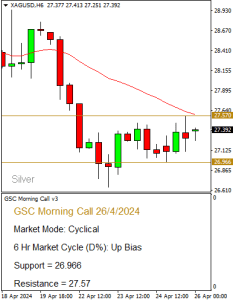

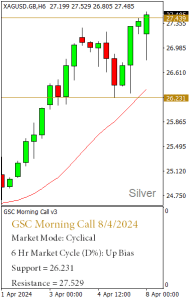

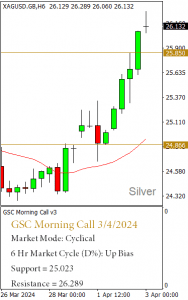

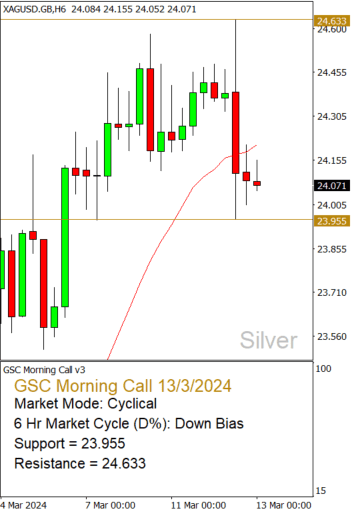

SILVER 1 OZ: SGD 37.46

|

PLATINUM 1 OZ: SGD 1345.59

|

Updated: 08/05/2024 10:00 AM

We are a Singapore registered company that specialises in physical bullion trading in Gold, Silver and Platinum at real-time pricing, completed with a whole array of services.

+65 6222 9703 | Mon to Fri: 10am to 5.45pm | Sat: 10am to 12.45pm

Email: enquiry@goldsilvercentral.com.sg

GoldSilver Central Pte. Ltd.

3 Pickering Street #01-15/16 Nankin Row Singapore 048660