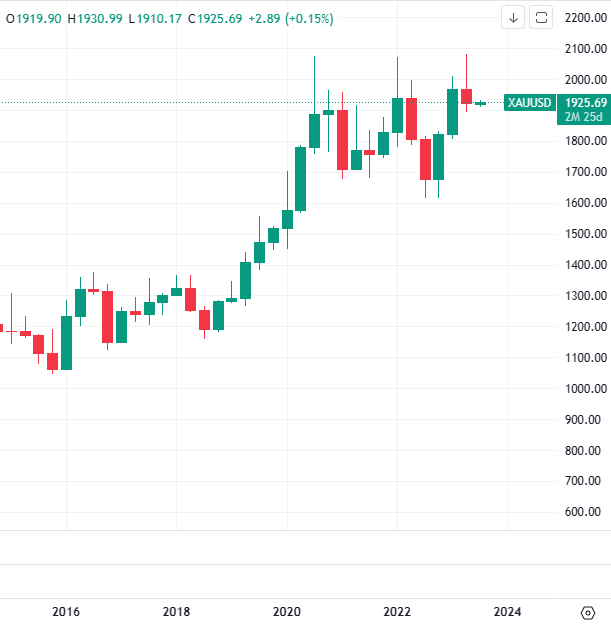

Gold Quarterly Outlook (Q3 2023)

Based on our internal analytic system, there is a good chance of gold price continuing its downtrend for the current quarter (July-Sep 2023). Having said that, the expected drawdown will be rather limited, like what we have seen in Q2 2023 as the selling momentum is still weak at the moment. Gold price is likely to retest last quarter low around 1892USD/oz. A break below 1890USD/oz might open the door towards 1804USD/oz which was the 2023 low. However, chances of hitting 1804USD/oz is still low unless selling momentum picks up over the next 3 months.

Silver Quarterly Outlook (Q3 2023)

Based on our internal analytic system, silver has a relatively similar outlook as Gold. We expect silver to continue its downtrend for another quarter (July-Sep 2023). Silver is likely to revisit Q2 low around 22USD/oz. A break below 22USD/oz might lead Silver to trend lower towards 20USD/oz which was the low for 2023. Again, chance of hitting 20USD/oz is rather slim right now considering the selling momentum is still very weak.

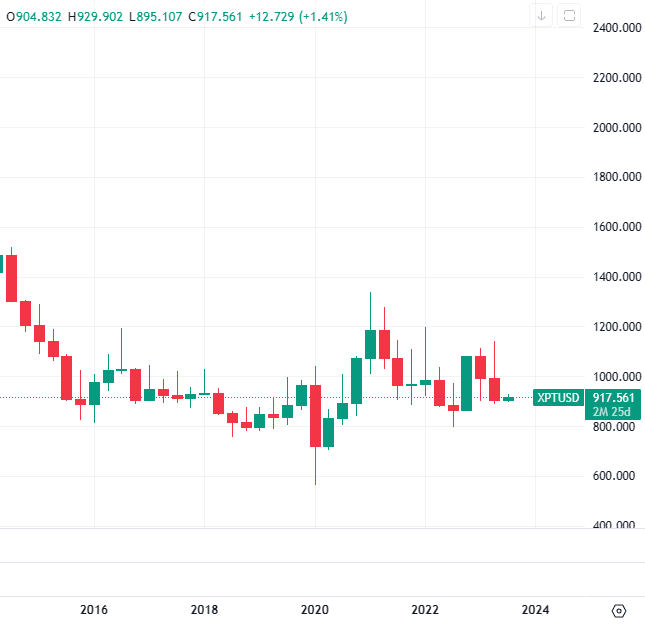

Platinum Quarterly Outlook (Q3 2023)

We also expect Platinum price to fall in the Q3 2023. The selling momentum for Platinum is picking up since the beginning of 2Q 2023. Hence, we might see a bigger drawdown on Platinum. The first important level to watch is 885USD/oz which was the low for 2023. If Platinum breach below 885USD/oz, we might expect the price trending toward 820USD/oz region, which was the 2022 low.

GoldSilver Central offers a wide range of products such as physical precious metals, GSC Savings Accumulation Program and GSC Live! app to help customers to manage their precious metals portfolio effectively. Contact us at +65 6222 9703 or via Whatsapp (+65 88939255) to find out more!