GoldSilver Central would like to take this opportunity to wish our beloved nation a happy and joyous 58th National Day!

As we celebrate the achievements of our great country, let us also reflect on our past and rejoice in the progress that has been made.

From its humble beginnings as a newly independent state, Singapore has grown to become a prosperous and vibrant nation. We have seen much progress in the last 58 years – from its transformation into a modern city-state, to the development of world-class infrastructure and public services.

Happy 58th National Day Singapore!

Personal Finance: Understanding Its Importance

Before delving into the details, it is crucial to comprehend why personal finance holds such significance. Understanding where your money goes and how to allocate it effectively is key to achieving financial goals. By mastering the fundamentals of personal finance, you gain the power to make better financial decisions.

1.1 Financial Security: A Compelling Drive

One compelling reason to grasp personal finance lies in achieving financial security. By skillfully managing your income and expenses, you empower yourself to save and invest wisely, paving the way for long-term stability.

1.2 Debt Management: Taking Control

A firm grip on personal finance can also aid in managing debt efficiently. By comprehending loan terms and interest rates, you can devise a plan to minimize debt swiftly and effectively.

1.3 Future Planning: Crafting Your Path

Knowledge of personal finance proves invaluable when planning for the future. Whether your dreams involve homeownership, entrepreneurship, or retirement savings, understanding personal finance concepts helps you reach these milestones with greater efficiency.

Setting Financial Goals: Paving the Way

Embarking on personal finance planning necessitates defining your financial goals. It is essential to identify what you strive to achieve with your money before crafting a roadmap to success.

2.1 Short-Term Goals: Embracing the Near Future

Short-term financial goals encompass achievements within the next five years. This may entail paying off credit card debt, saving for a dream vacation, or accumulating a down payment for a car.

2.2 Medium-Term Goals: Embracing the Horizon

Medium-term goals encompass targets to be achieved within the next five to ten years. This could include saving for a home down payment, venturing into entrepreneurship, or paying off student loans.

2.3 Long-Term Goals: Embracing the Journey

Long-term goals encompass financial objectives spanning over ten years. This often involves saving for retirement, funding a child’s education, or building a robust investment portfolio.

Assessing Your Financial Situation: The Starting Point

Once your financial goals are defined, the next step is evaluating your current financial situation. This entails calculating your net worth, which is the difference between your total assets and liabilities.

3.1 Income: Fueling Your Financial Journey

Begin by listing all your sources of monthly income, including your salary, bonuses, commissions, side gig earnings, or any regular inflows.

3.2 Savings: Building Your Safety Net

Next, assess your total savings, encompassing traditional and high-yield savings accounts, certificates of deposit, and money market accounts.

3.3 Investments: Growing Your Wealth

Consider any investments you hold, such as stocks, bonds, precious metals, mutual funds, real estate, or retirement accounts.

3.4 Assets: Valuing Your Worth

List your assets, including your home, car, and any other valuable possessions, using their current market values.

3.5 Expenses: Navigating Your Financial Landscape

Finally, outline all your monthly expenses, ranging from rent or mortgage payments to utility bills, groceries, transportation costs, and other regular expenditures.

By embarking on this journey of understanding and implementing personal finance strategies, you empower yourself to navigate the financial landscape with confidence and achieve your desired financial future.

Creating a Budget: Mastering Your Money

Having a budget is the cornerstone of successful personal finance management. It empowers you to take control of your finances and ensures that you’re living within your means.

4.1 Allocating Funds: Prioritizing Your Priorities

When creating your budget, it’s crucial to allocate funds for your essential expenses first. Think of it as building a solid foundation for your financial well-being. Start by earmarking money for housing, food, and transportation, and then you can indulge in non-essential expenses like entertainment and dining out.

4.2 Paying Off Debt: Breaking Free from the Shackles

Your budget should also include provisions for paying off any lingering debt. Liberating yourself from debt is paramount, as it saves you from paying unnecessary interest charges. Remember, the sooner you pay off your debt, the faster you’ll be on your way to financial freedom.

4.3 Saving for Goals: Dream Big, Save Smart

In addition to expenses, your budget should include savings for your short-term, medium-term, and long-term goals. Make it a habit to pay yourself first by setting aside a portion of your income for savings before allocating money for other expenses. This way, you can turn your dreams into reality.

GSC Savings Accumulation Program (GSAP) is a versatile savings program designed to help people achieve their financial goals. It offers a convenient way to accumulate and manage Precious Metals Holdings in physical Gold, Silver and Platinum. Unlike most savings programs which may require longer periods of time for maturity, you may liquidate your precious metals holdings or convert them into physical precious metals products after a minimum commitment period of 3 months. Learn more about GSAP today!

Preparing for Emergencies: Expecting the Unexpected

Building an emergency fund is an essential part of personal finance management. This fund acts as a financial safety net, ready to catch you when unexpected expenses or financial emergencies arise.

5.1 Importance of an Emergency Fund: Weathering the Storm

An emergency fund is a true lifesaver. It shields you from unexpected costs like car repairs or medical bills without relying on credit cards or loans that can trap you in a cycle of debt. It’s like having your own superhero in times of crisis.

5.2 Size of Emergency Fund: Tailoring it to You

Ideally, your emergency fund should cover three to six months’ worth of living expenses. However, the exact amount depends on your personal circumstances, such as your monthly expenses, income stability, and tolerance for risk. Customize it to suit your needs and sleep soundly knowing you’re prepared.

5.3 Where to Keep Your Emergency Fund: Easy Access, Peace of Mind

Your emergency fund should be easily accessible when the need arises. Consider keeping it in a high-yield savings account that offers better interest rates than regular savings accounts, ensuring that your money grows while remaining within reach.

Understanding personal finances may be daunting at first. However, once you get a hang of it, it would bring you closer to your financial goals. Create a better financial future for yourself by equipping yourself with financial knowledge today!

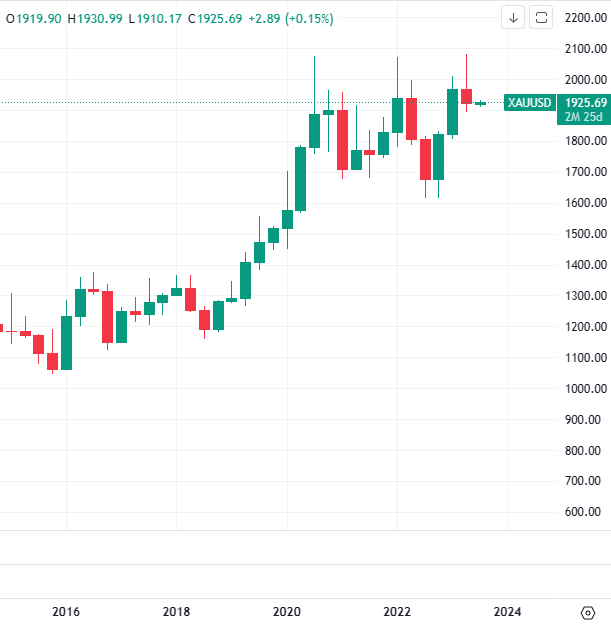

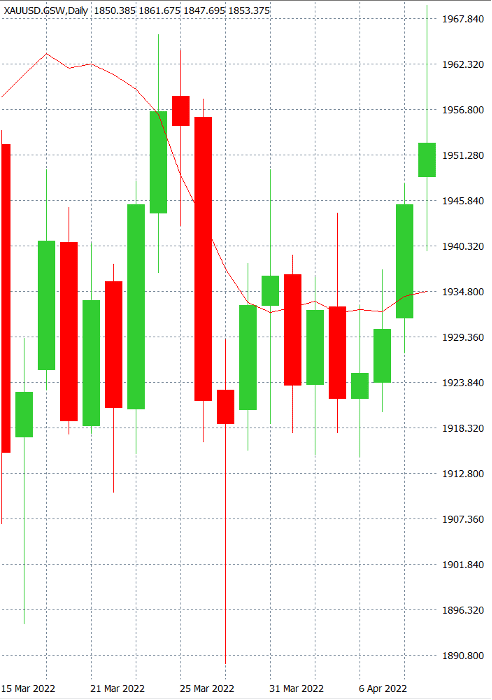

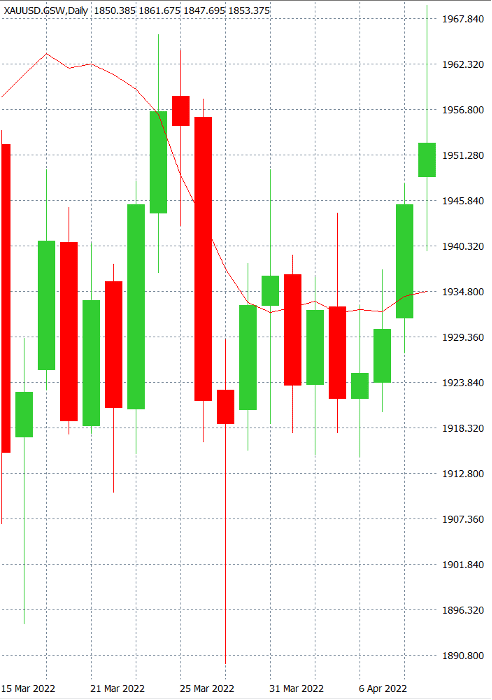

Gold Quarterly Outlook (Q3 2023)

Based on our internal analytic system, there is a good chance of gold price continuing its downtrend for the current quarter (July-Sep 2023). Having said that, the expected drawdown will be rather limited, like what we have seen in Q2 2023 as the selling momentum is still weak at the moment. Gold price is likely to retest last quarter low around 1892USD/oz. A break below 1890USD/oz might open the door towards 1804USD/oz which was the 2023 low. However, chances of hitting 1804USD/oz is still low unless selling momentum picks up over the next 3 months.

Silver Quarterly Outlook (Q3 2023)

Based on our internal analytic system, silver has a relatively similar outlook as Gold. We expect silver to continue its downtrend for another quarter (July-Sep 2023). Silver is likely to revisit Q2 low around 22USD/oz. A break below 22USD/oz might lead Silver to trend lower towards 20USD/oz which was the low for 2023. Again, chance of hitting 20USD/oz is rather slim right now considering the selling momentum is still very weak.

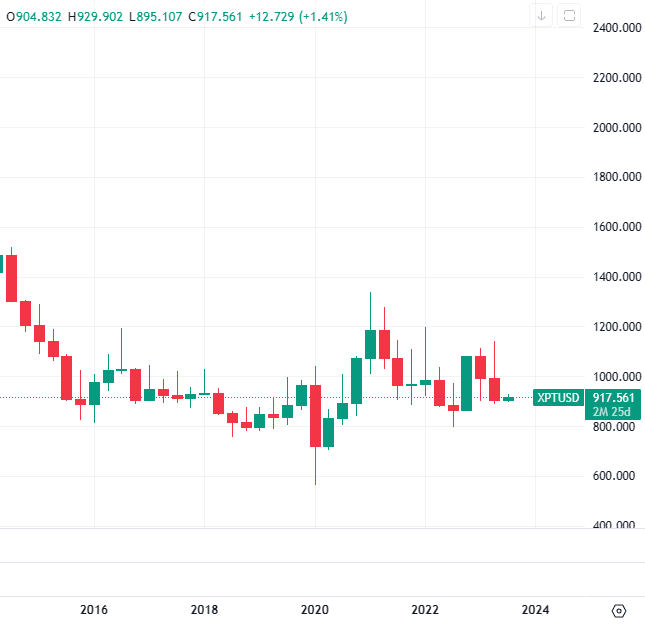

Platinum Quarterly Outlook (Q3 2023)

We also expect Platinum price to fall in the Q3 2023. The selling momentum for Platinum is picking up since the beginning of 2Q 2023. Hence, we might see a bigger drawdown on Platinum. The first important level to watch is 885USD/oz which was the low for 2023. If Platinum breach below 885USD/oz, we might expect the price trending toward 820USD/oz region, which was the 2022 low.

GoldSilver Central offers a wide range of products such as physical precious metals, GSC Savings Accumulation Program and GSC Live! app to help customers to manage their precious metals portfolio effectively. Contact us at +65 6222 9703 or via Whatsapp (+65 88939255) to find out more!

Dear Friends and Valued Customers,

At GoldSilver Central, we believe in celebrating the richness of diverse cultures and traditions. As the Dragon Boat Festival draws near, we want to take a moment to extend our heartfelt wishes for a joyous and blessed celebration to all our viewers.

The Dragon Boat Festival, also known as Duanwu Festival, is an iconic event that has been celebrated for centuries in various parts of Asia, particularly in China. This colorful festival is held on the fifth day of the fifth month of the lunar calendar, which usually falls in June. It is a time when communities come together to commemorate the life and death of the great poet and statesman, Qu Yuan.

Legend has it that Qu Yuan, a loyal advisor to the Chu kingdom during the Warring States period, drowned himself in the Miluo River as an act of protest against political corruption. The locals, deeply saddened by his death, raced out in their boats to save him or at least retrieve his body. They beat drums and threw rice dumplings, called zongzi, into the river to distract the creatures from harming Qu Yuan’s remains. This act of racing, drumming, and tossing zongzi has become the centerpiece of the Dragon Boat Festival, symbolizing bravery, unity, and the triumph of the human spirit.

During this festive occasion, families and friends come together to enjoy thrilling dragon boat races, where intricately designed boats, often painted like dragons, glide across the water with synchronized paddling. The exhilarating atmosphere, accompanied by the rhythmic beats of the drums, fills the air with excitement and solidarity.

At GoldSilver Central, we embrace the spirit of the Dragon Boat Festival. We take this opportunity to reflect on the values it represents: the strength of community, the pursuit of righteousness, and the importance of standing united in the face of adversity.

On behalf of our team, we extend our sincerest wishes to you and your loved ones for a blessed Dragon Boat Festival. May this joyous occasion bring you renewed inspiration, happiness, and prosperity. Let us continue to cherish and preserve the beautiful traditions that unite us all.

Happy Dragon Boat Festival!

Sincerely,

GoldSilver Central

Akshaya Tritiya, falls on this coming Saturday, 22 April 2023 is a Hindu festival celebrated on the third day of the bright half of the Indian lunar month of Vaishakha. This day is considered to be auspicious for new beginnings, investments, and the purchase of valuable items, especially gold. The tradition of buying gold on Akshaya Tritiya dates back to ancient times, where it was believed to bring prosperity, wealth, and good fortune to the buyer.

In Hindu culture, gold is considered to be a symbol of wealth and is often associated with the goddess of wealth, Lakshmi. Purchasing gold on Akshaya Tritiya is believed to ensure that the buyer’s wealth increases in the coming years. This belief has been deeply ingrained in the Hindu culture, and it continues to be a popular practice in India and other parts of the world.

Apart from being a symbol of wealth, gold also has auspicious properties that ward off negative energies and bring good luck. This makes it an ideal gift for weddings, which are often held on Akshaya Tritiya. Many people buy gold jewelry as a gift for the bride or groom on this day, as it is believed to bring good fortune to the newlyweds.

In conclusion, the tradition of buying gold on Akshaya Tritiya is deeply rooted in Hindu culture and traditions. It is believed to bring prosperity, wealth, and good fortune to the buyer, and it continues to be a popular practice in India and other parts of the world. The auspicious properties of gold also make it an ideal gift for weddings, which are often held on this day. Therefore, buying gold on Akshaya Tritiya is an important cultural practice for many Hindus.

Looking to buy gold this Akshaya Tritiya or any time of the year? Check out our Akshaya Tritiya Specially Curated Selection for a wide range of bullion options.

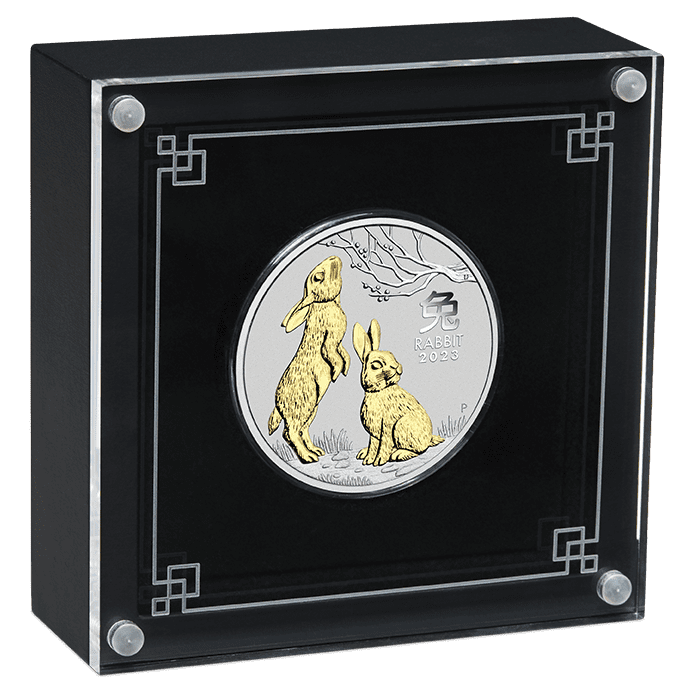

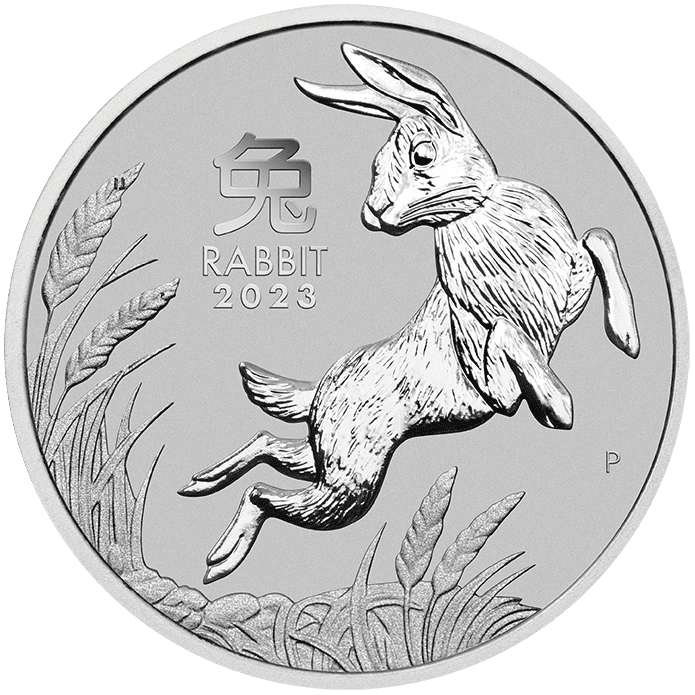

Shine Bright Like a Gilded Rabbit: The 2023 Australian Rabbit Gilded Proof Silver Coin

Are you a fan of adorable rabbits? If so, you’ll love the 2023 Australian Rabbit Gilded Proof Silver Coin 1oz, limited to only 23,500 issues!

This coin features a beautifully detailed gilded rabbit on the reverse side, with one rabbit alert and the other stretching towards a budding branch, adding a touch of whimsy to the design. The obverse side of the coin showcases a portrait of Queen Elizabeth II, lending a touch of royal elegance to this playful piece.

Crafted from one ounce of 99.99% pure silver and selectively gilded with 24-carat gold, this coin is a stunning piece of art. The gilded finish on the rabbit gives it a unique and collectible appeal, setting it apart from other silver coins.

So, if you’re a fan of cute and cuddly things, consider adding the 2023 Australian Rabbit Gilded Proof Silver Coin 1oz to your collection. Every time you see it, the coin is sure to bring a smile to your face. Place an order today!

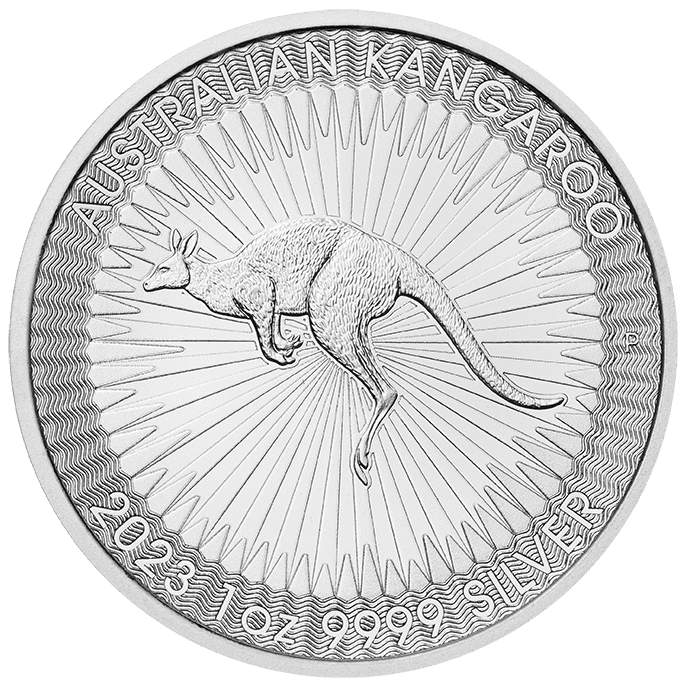

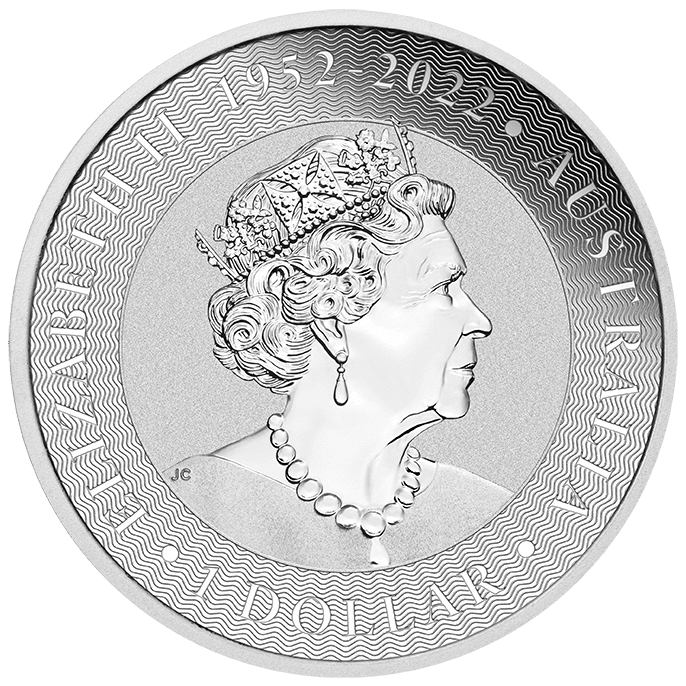

2023 Australian Kangaroo Silver Coin 1oz – It’s extra special this year!

The Australian Kangaroo Silver Coin 1oz is a beloved treasure for collectors and investors alike. Not only is it a Precious Metal investment, but it’s also a charming representation of Australia’s iconic kangaroo. The coin is minted in 99.99% pure silver, ensuring its high value and quality. Its beautifully crafted reverse side depicts a jumping red kangaroo, adding a touch of cuteness to your collection.

But that’s not all! This year’s edition of the coin features a modified obverse design that commemorates the passing of The Late Majesty Queen Elizabeth II, who served as Australia’s Head of State for an impressive 70 years until September 2022. This makes the coin extra special and adds a touch of royal elegance to your collection.

The Australian Kangaroo Silver Coin is a smart investment option due to its high purity and limited availability, and its iconic kangaroo design only adds to its appeal. Whether you’re a seasoned collector or just starting out, the 2023 Australian Kangaroo Silver Coin 1oz is sure to bring joy and value to your collection. Don’t miss out on the chance to own a piece of Australia’s iconic wildlife and a valuable investment. Order your 2023 Australian Kangaroo Silver Coin 1oz today!

Dear Valued Clients,

As announced in Budget 2022 by the Minster of Finance, the GST rate will be increased from 7% to 8% with effect from 1 January 2023 and from 8% to 9% with effect from 1 January 2024.

Starting on 1 Jan 2023, GoldSilver Central will begin collecting GST at this new rate of 8% on our products (except for those defined under Investment Precious Metals which are GST exempted in the GST Act) and services to clients. Examples of services which will be subject to 8% with effect from 1 Jan 2023 are:

1) Storage charges under GSC Bullion Storage Program

2) Handling and Transfer fees under GSC Bullion Storage Program

2) Storage fees under GSC Savings Accumulation Program (“GSAP”)

Please note that for purchases of goods and services with us on or after 1 Jan 2023, GST will be chargeable at 8% unless full payment is received by 31 December 2022.

For more information, please refer to the following Government announcements below:

GST Rate Change (consumer):

GST Rate Change for Consumers (iras.gov.sg)

rate-change-flowchart-for-

GST Rate Change (business):

IRAS | Overview of GST Rate Change

etaxguide_2023-gst-rate-

Thank you.

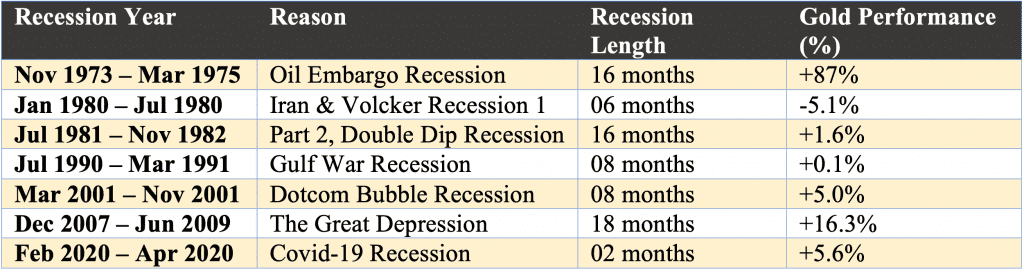

A recession in US seems likely, but will Gold be a good asset to own if a recession hits?

Recession is defined as a significant, widespread and prolonged downturn in economic activity. Usually many will term that a country is in recession if there are 2 consecutive quarters of decline in GDP.

Currently, US is not in a recession yet, but many analysts have mentioned that a recession is a very likely scenario if the Fed continues their aggressive stance of raising interest rates to combat inflation. Higher interest rates will increase the cost of borrowing, businesses and consumers will likely cut back on their spending and hiring which will in turn lead to less economic activities.

If US goes into a recession, the popular investment portfolio of holding majority equities might be greatly challenged and many would look at diversifying into other asset classes to tide through this period.

Gold during past recessions

From the above past recessions after the Bretton Woods system collapsed (USD no longer pegged to Gold after 1973), Gold has held up well during recessions except during the Iran & Volcker recession.

Gold seems to have put up a good case for investor to consider especially if the US economy goes into a recession. Will you be looking to add some Gold into your portfolio this period as a safe haven asset?

If I wish to, how much of my portfolio should I then look to allocate to precious metals? This might be the question that you would like to ask. Fret not, we will touch on this in one of our articles, so stay tuned or alternatively, email us at enquiry@goldsilvercentral.com.sg or speak to us at +65 62229703 and we will be more than happy to work on this together!

Always remember that periodic management of an investor’s portfolio is important as this will ensure you keep track of your investments and allocate your funds to the asset class that might provide you with a higher return during that period! Also, never put all your eggs in one basket, especially during periods of uncertainty in the economy.

Disclaimer

Please note that past performance is not indicative of the future or likely performance of Gold. This is merely for information and data contained in this article has been obtained from sources believed to be reliable, but GSC makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Please note that none of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell Gold.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.

Brian

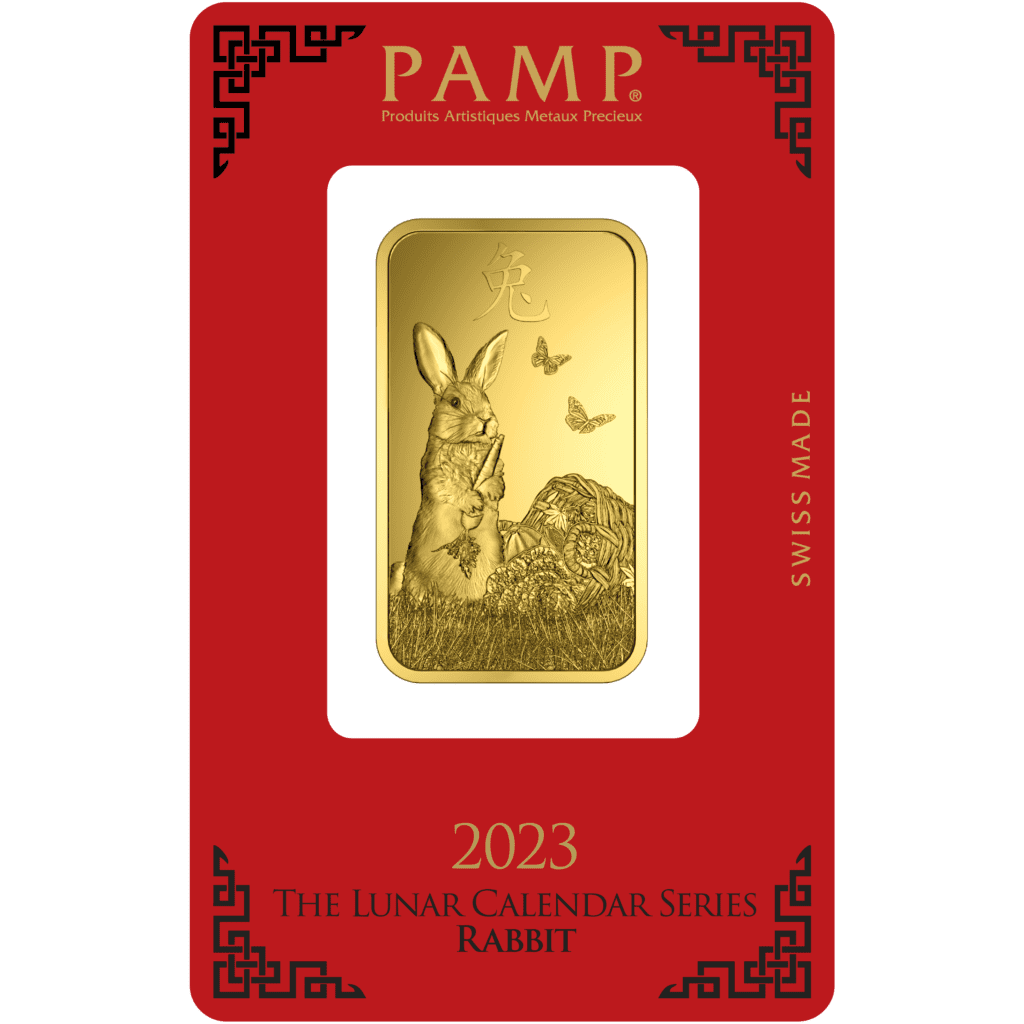

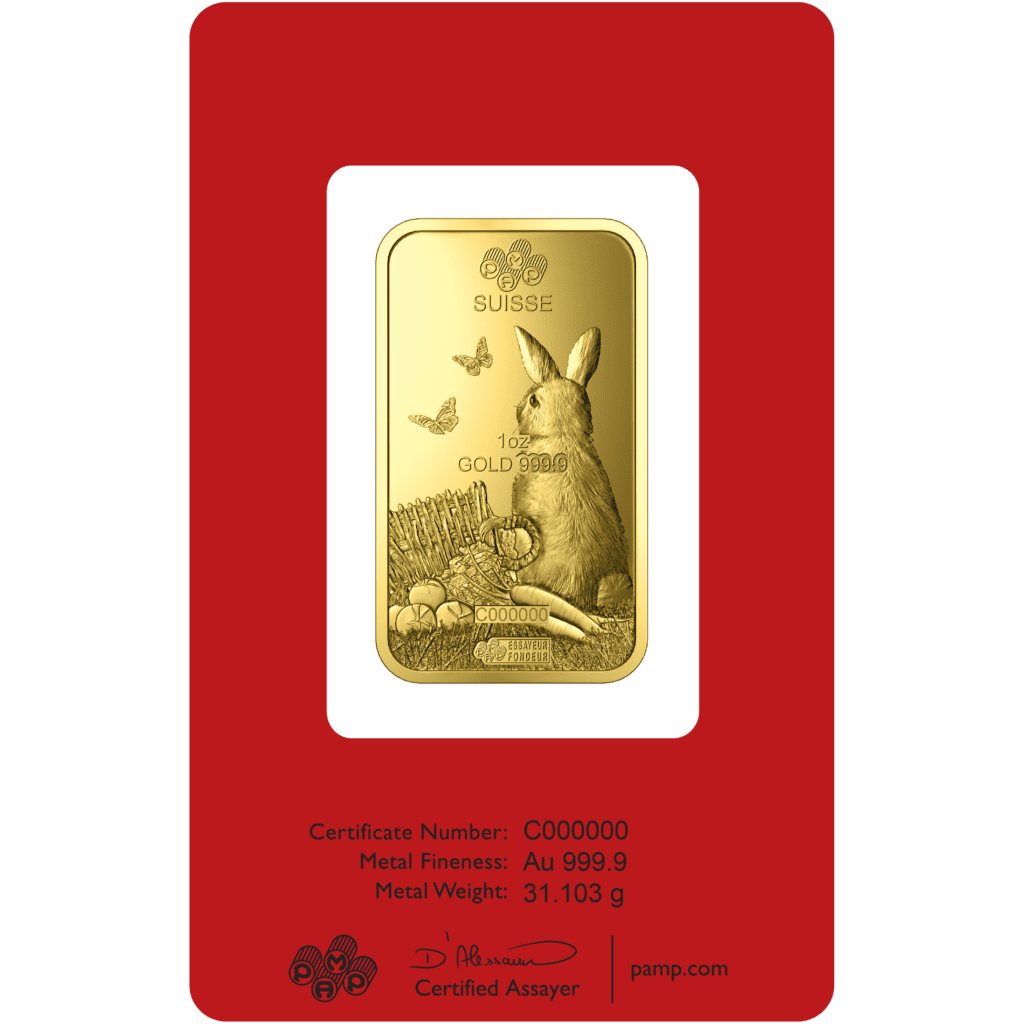

Get excited! Pamp Suisse and Australian Lunar Rabbit Bars and Coins are available for pre-order now!

Get excited! Pamp Suisse and Australian Lunar Rabbit Bars and Coins are available for pre-order now!

Pamp Suisse Lunar Rabbit Gold and Silver Bar

Following the lunar cycle, 2023 is the Chinese Year of the Rabbit, and is celebrated from the 22nd of January 2023 through to 9th February 2024. The latest addition to the popular Lunar Calendar Series celebrates the Rabbit with an ingot design featuring exceptional artwork original to PAMP, rich in traditional Chinese symbolism.

Available in 5g or 1oz of fine gold, or 10g or 1oz of pure silver, this charming design celebrates the Rabbit as the luckiest of the Chinese zodiac symbols. The Rabbit possesses a gentle nature, elegance and beauty, patience, alertness, a responsible nature, and represents long life.

The Rabbit is a very social creature once trust is established. Thanks to its agility and speed it will persevere and overcome obstacles to achieve a goal.

Its lucky directions are east and south, & it is strongly associated with the moon in ancient Chinese folklore. Water is the element associated with the 2023 Lunar New Year and here a Rabbit facing east snacks on a carrot plucked from an overturned basket of fresh vegetables harvested after a season of temperate rainfall. In the foreground is the napa cabbage, considered extremely lucky in Chinese culture.

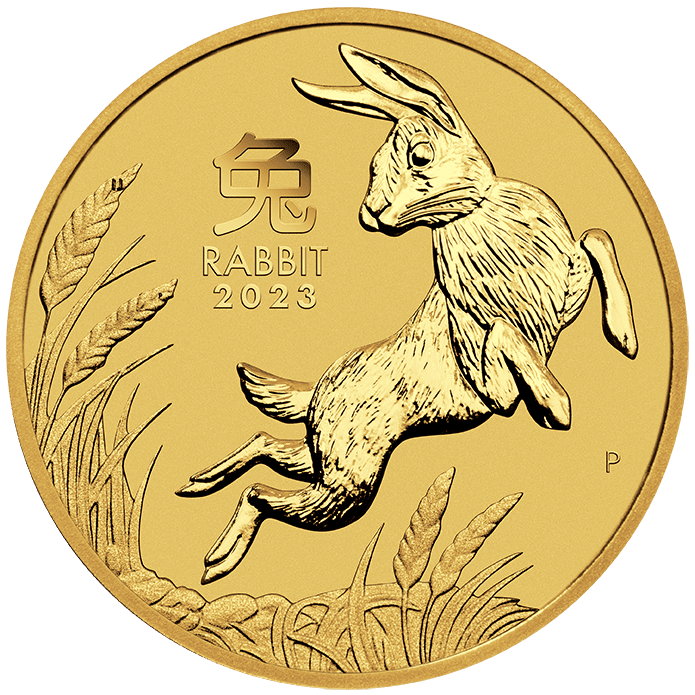

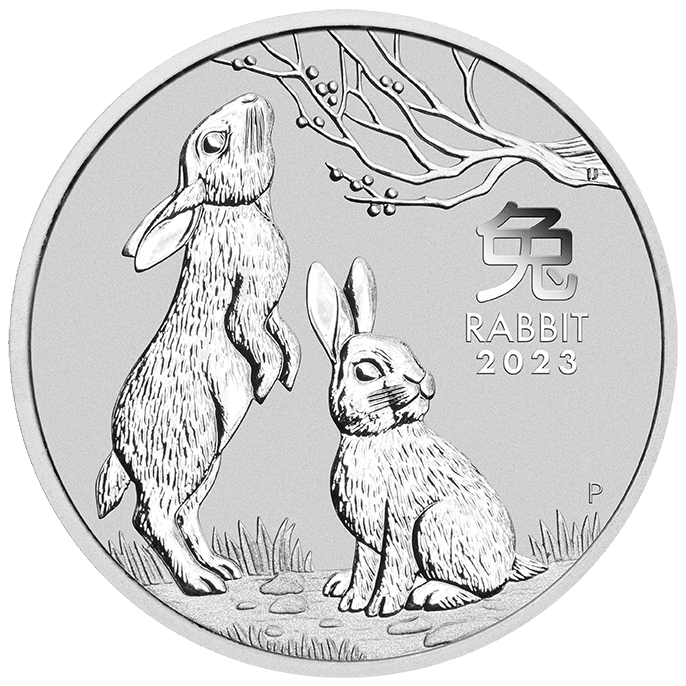

Australian Lunar Rabbit Gold, Silver and Platinum Coin 1oz

2023 Year of the Rabbit coins feature the work of Ing Ing Jong, a member of the Mint’s design studio since 2011 – the previous rabbit year!

Capturing the animal in different moods, Gold and Platinum coins portray an energetic rabbit leaping among grasses with feathery plumes, while her silver artistry is a tranquil image of two rabbits under a budding springtime branch.

According to legend, the rabbit finished fourth in the Great Race, held to determine which animals should be represented in the lunar zodiac. Consequently, it has represented every fourth year in the 12-year lunar cycle.

Intelligence, creativity, vigilance and compassion are said to be among the personality traits bestowed on those born under the rabbit’s influence in 2023.

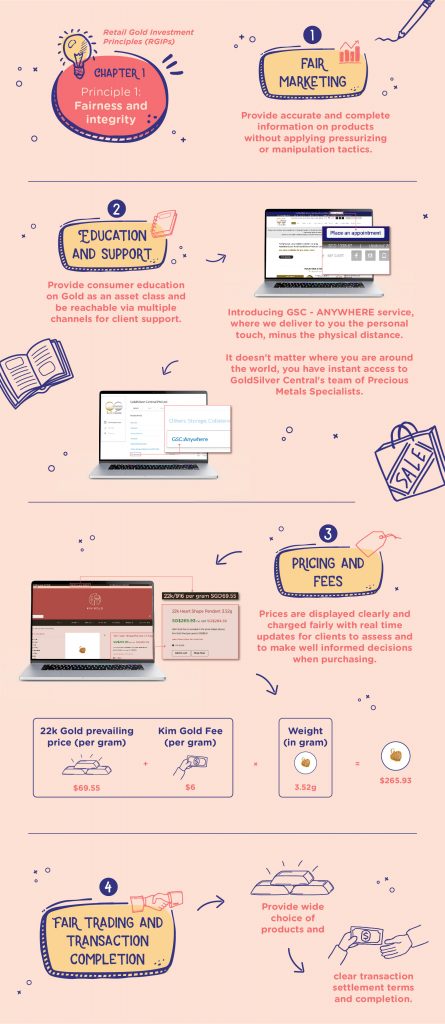

In our previous article, we have given a brief introduction of Retail Gold Investment Principles (“RGIPs”). As mentioned, RGIPs consist of a recommended checklist of seven listed principles. This week, we will look at the first principle, “Fairness and integrity”. So what does this mean?

“Fairness and integrity” explains a provider must treat customers fairly and act with integrity, from information and service provision through to transaction completion. It covers general guidance in four areas: fair marketing, education and support, fair pricing and fees, and fair trading and transaction completion.

GoldSilver Central/Kim Gold serves our valued clients with integrity, knowledge and capability. As part of practising RGIPs, we have put in place stringent processes and are selective on the jewellery pieces we pick to ensure authenticity, quality and to meet the standards for weight and purity. We, together with our valued clients, value ethical, responsible purchasing and sustainable living.

If you are interested to read more about the RGIPs, click here.

#GSCxRGIPs

Evon

What are the Retail Gold Investment Principles (RGIPs)… and more importantly, how does it impact investors?

Retail Gold is global — with private investors holding approximately 45,000 tonnes of Gold in bars and coins (that’s around 22% of all the Gold mined throughout history). In fact, bar and coin demand accounts for 25% of annual global Gold demand — representing over 1,000t of retail Gold investment each year. But, beyond bars, coins, and collectibles, Gold ownership has long transcended the need for physical storage. As technology continues to pervade many aspects in our modern lifestyles, investors have also now begun to own Gold in digital formats vaulted on investor’s behalf and operated via mobile apps and websites.

Although retail Gold markets generally operate under local regulation in different jurisdictions, more initiatives were mooted on ways to enhance transparency and build further trust in the retail Gold marketplace. Subsequently, after conducting in-depth research globally, the World Gold Council developed the Retail Gold Investment Principles (RGIPs) as a set of guidelines to steer deeper trust and build relationship between Gold investors and their service providers for a sustainable healthier retail Gold marketplace.

Determined to benefit both retail investors and industry practitioners, the RGIPs was first established by The World Gold Council in August 2020. A recommended checklist of seven listed principles form the basis of how service providers should operate and how investors can identify trustworthy providers fulfilling these guidelines in the diverse retail Gold market.

Since its release, the World Gold Council’s guides have made quite the global impact with adoption in key markets like Singapore, India, China, Germany and North America. Subsequently, the World Gold Council continues to advocate adherence to the Retail Gold Investment Principles by engaging providers and stakeholders worldwide.

These efforts include:

So this is just our first snippet of RGIPs and we hope that you have a better understanding of why this topic will feature regularly in our upcoming articles. We will be covering each principle area in the coming weeks so please stay tuned to our blog. Feel free to reach out to us at +65 62229703 or enquiry@goldsilvercentral.com.sg if you have any feedback or comments to add. Meanwhile, stay safe.

#GSCxRGIPs

Reposted from Kim Gold

The Festival of Lights, also known as Deepavali, is widely celebrated every year by Hindus. The first day of Deepavali, Dhanteras, is typically a day of peak sales in Gold annually in India. Dhanteras is a combination of the words, “dhan” (signifying wealth), and “teras” (which means 13th day), and is considered opportune to purchase some form of Gold on this auspicious day.

Why is it auspicious to buy Gold during Deepavali?

The Hindu community views Gold as an embodiment of Goddess Lakshmi, the Goddess of Wealth. Therefore, the ritual of buying Gold bullion or jewellery on Deepavali is believed to invite Goddess Lakshmi to their home and to bless the families with an abundance of wealth.

The legend behind Dhanteras

Once upon a time, King Hima had a son and astrologers predicted the death of the Prince would be on the 4th day of his marriage due to snake bite.

In order to save her husband’s life, the Princess placed all the Gold ornaments in front of the main door to block the snake from entering their palace. With the help of the Gold ornaments, the snake was blocked as their dazzling brilliance nearly blinded the snake.

Thus, the legend of how the Prince was saved from impending death inspired the ritual of buying Gold on the first day of Deepavali. Read More.

This year, we are running a Deepavali special promotion, featuring precious Gold and Silver products. As is commonly known, the Ox is a sacred animal for majority Hindu community, so the Australian Lunar Ox Silver Coin 1oz is on promotion too! Check out our exclusive items here! Grab this chance to get an item from us for additional luck and wealth during this Deepavali!

Gold has never been something that I want to own all along – instead now I believe it is one of the best assets for me to own right now

A summer low in Gold is frequent enough to be noticeable, but not consistent enough to be reliable. Somehow like my erratic mood swings.

Much younger days, I used to think that Gold jewellery is so old fashioned, and the bling bling feel is too loud to be worn as an accessory. It has never crossed my mind even to own it.

However, Gold tends to fascinate and grows on me more when I finally get in touch with precious metals in GSC, changing my perspective on owning Gold bullion. Also after realising the value of Gold and every investor is different; those who invest in Gold do so for a variety of reasons. Investing in Gold has never been so popular. Valued for its ability to perform well during times of boom and bust, Gold has been trusted by investors all over the world for millenniums. The fact is investors who started accumulating bullion in the early years when Gold price was so low had made their profits as of now regardless how the prices fluctuate through these years. Witnessing the investors that I had come across from the time I learn about bullion, they invested and had multiplied over the years, and now they are harvesting their fruits – the gains. Of course, these are long term holders of Gold and has always held Gold in their portfolio; they have also been optimising their portfolio, using other tools such as borrowing against their holdings or liquidating it when it has appreciated to move into other asset classes and then move back into Gold when it seems like Gold will outperform other asset classes. These are all available and offered by GSC, feel free to reach out to us or click here to drop us an email for us to follow up with you.

Nothing beats the foresights and trust those investors had in bullion all the time despite the volatility and fluctuation in the Gold prices. In terms of price, the high for the year was $2,072 per ounce – in March, shortly after Russia invaded Ukraine. The low for the year was $1,680 – that came in end July. Currently Gold is just above S$1700 levels and is worth looking at.

Gold is something that you can own physically at any point of time, no counterparty risk and glad I do have some as they were gifted to me, and I’m truly blessed for that. I’ve strongly believe it’s a way for wealth preservation regardless of time, and more so in an impending recession!

Connie

We have seen ETF outflows and falling open interests in Gold futures thus far, seems like the “summer doldrums” as many coined this term for Gold is back after being absent for the last 2 years.

Interestingly, World Gold Council has released Central bank Gold data and Central banks were net buyers of Gold up to July. These price levels seem to be attractive to Central banks and if this will continue to later parts of this year is yet to be seen.

WGC has reported that Gold is doing well in many currencies except in USD, CAD and we know for SGD (Table 1)too thus far. Based on their report, Gold is seems to be a good asset class to hold during recessions together with corporate and treasury bonds (Chart 1). However, at this moment, we are not in a recession and even if US enters into a recession, will Gold continue to shine during this period? It is important to be diversified to tide through difficult periods and seize opportunities when it presents itself. Holding precious metals in a portfolio is important and seems to make sense based on the data presented, however, the rule of thumb is always not to put all your eggs in one basket.

Chart 1:

Brian

“I was accumulating my Precious Metals investment and now prices are going down. Should I continue or stop?”

“I needed some cash flow but to sell my holdings now puts me at a loss, should I just sell and take the losses?”

The above are some of the situations we’ve heard from investors lately. There are various solutions, and we would like to share a few in this article.

At the end of the day, it really depends on what your objectives are and which are the most suitable or comfortable for you to execute. Generally, most people accumulate Precious Metals to hold for the long term. Some even use Precious Metals as part of their legacy planning. As such, when prices are down, investors should grab this opportunity to accumulate more holdings which will bring down the average acquisition cost.

Another good practice is to allocate a standard investment sum monthly to buy/accumulate consistently (daily). This exercise will help you accumulate more metals when prices are low and accumulate less when prices are high.

If you are paying for the storage fee or holding cost, it means your average cost will just keep going up. However, if you continue to accumulate, your average cost may go up or it may stay stagnant.

We’ve seen scenarios where investors will decided to sell their holdings and re-purchase with an accumulation plan. This example is considered a little extreme but it does help cut down the current monthly storage/holding cost when re-purchasing at a new lower average cost. This helps investors who may have limited funds and are unable to fork out more for the storage/holding cost, but at the same time, would like to continue holding this asset.

For the above scenario, there is another way to approach this which is to collateralise the asset. Investors can choose to still own the asset by collateralising it to get some funding. There will still be some interests’ charges, but at least this method will resolve short-term financing issues. Many have opted for this approach to carry them through tough times or to wait for the prices to move higher to sell at a better rate.

We’re just sharing some of the common approaches to managing Precious Metals holdings in the event of falling prices, but these are definitely not the only options.

Please feel free to reach out to us and we are more than happy to discuss more with you!

Suzane

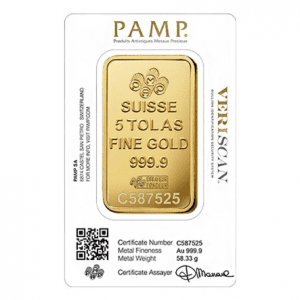

Today I will be sharing varying types of security features in place from various bullion manufacturers to prevent the circulation of counterfeit bullion bars in the trade.

I will be sharing a few of the popular brands and their security features. This includes Argor Heraeus, Valcambi, Metalor and last but not least, Pamp Suisse.

Argor Heraeus is using the Kinegram technology for their precious metal products. This results in a defractive image embossed into the substrate of the metal, which not only creates a mesmerizing effect, but also adds to its authenticity. They are also packaged in unique tamper-proof sealed eco-compatible PET blister packs. This results in a beautiful and secure presentation for the gold bars inside.

Valcambi is using a type of authentication technology developed in Switzerland by paira suisse. It can be identified by the presence o

Metalor has applied a special high-security ink to the surface of the bullion adding negligible weight. The authenticity process is broken into three parts, visual check of security seal, quick verification using a blinking light system and a unique QR code embedded in the seal. This allows for immediate verification of security seals even with limited space, lighting and without an internet connection. In short, 100 kilobars can be checked in less than one minute.

To summarise, there are many security features to be aware of and many counterfeits circulating in the market currently. It is in your best interest to look for a reputable bullion dealer should you decide to invest in bullion assets. With the industry leading tools and years of experience, we can make your bullion journey a smooth sailing one. Feel free to check out our store or call us up should you have any questions on starting your bullion journey.

Dillon

Did you know that there are 118 elements in the periodic table, and around 92 of them are metals. What do you think separates Precious Metals from base metals?

Come, let’s explore the differences between these types of metals today.

As its name suggests, Precious Metals are scarce. Commonly known as Gold, Silver or Platinum these metals are also highly durable and often used in the production of fine jewelry as well as in industrial capacities.

Historically, gold was used as a form of exchange way before the introduction of fiat currency.

In contrast, base metals are cheap, abundant and can be easily sourced. Examples of base metals include copper, lead, nickel, zinc and aluminum. Also, base metals are not corrosion resistant and are easily tarnished. In the US, corroded pennies are a common sight these days.

How to invest in precious metals and base metals?

There are several ways for anyone to invest in Precious Metals such as physical bullion, future contracts or Exchange Traded Funds (ETFs). The most secure way is owning a physical bullion as there are no counterparty risks involved. The owner can directly sell or trade it anywhere in the world.

For base metals, investors can trade its future contracts or through Exchange Traded Funds (ETFs). Both are cost effective, transparent and convenient ways to invest in base metals. You also don’t need to worry about storage. The costs for production (premiums) are also excluded from the ETFs.

Precious Metals (as they are highly liquid) will have thinner spreads as investors are always on the lookout to purchase them for the best price. On the other hand, base metals have a wider spread as they are illiquid when compared to Precious Metals such as Gold or Silver.

A wider bid/ask spread is an indirect cost in trading, especially for huge orders. A wider spread will equate to a higher premium for investors. To minimize volatility, using a limit order is a better option. GSC Live! allows you to place a limit order at your desired price with narrower spreads anytime, anywhere!

Read more about GSC Live!

Hopefully, this article has given you a basic understanding of the differences between Precious Metals and base metals. If you are interested in investing, buying or selling Precious Metals, feel free to reach out to us as we carry a wide range of LBMA accredited Gold, Silver and Platinum bullion that can help you diversify your investment portfolio.

Evonne

Today, I will be sharing with you some of the possible reasons that led to the recent fall in prices of Gold and Silver. Some contributing factors include the strength of the US dollar, high inflation that led to governments raising interest rates to combat rising inflation and industrial demand coming under pressure.

The price of precious metals and the US dollar tend to be inversely correlated. The dollar is trading close to its 20-year high, even the Euro which was the stronger currency has fallen parity against the dollar. The strength of the dollar is a result of capital flowing into the US dollar as investors deemed it as a safe haven asset spurred by the fear of a global recession.

Next, due to the aggressive monetary policy (increasing interest rates) to curb inflation, this in turn hurts the sentiment in precious metals since investors can yield a higher interest in seemingly safer treasury bonds. Usually, high inflation (latest data for inflation rate in US is 9.1%, highest in 40 years) is seen as positive for Gold and Silver prices, but this time interest rates also surged sharply due to government intervention mentioned above. Most investors will definitely look to next Wednesday’s (27th July) Fed meeting to know if the interest rates will be raised by 75 or 100 basis points.

Lastly, relating to industrial demand, Silver is considered both an investment precious metal and an industrial metal; 60% of Silver’s demand is from the industries. Demand for industrial goods reduces all over the world especially in China, due to Covid lockdowns which in turn caused silver prices to take a hit.

I hope you guys have a clearer macro-overview on what is happening globally that led to the fall in prices of Gold and Silver.

If you have any questions, please feel free to contact us to understand more. In the meantime, stay safe!

Dillon

The prices of Precious Metals fluctuate every millisecond. But what exactly affects or determines the prices? Supply and demand? Of course, that is one of the many common answers we hear. Let’s look at some of the other factors affecting the prices of Precious Metals today!

Dollar Index

The Dollar’s strength and weakness can affect Gold prices as the value of Gold and Dollars are inversely related. When the Dollar value increases, Gold prices tend to be lower, and vice versa when the Dollar value decreases.

Inflation

Gold is often seen as a safe haven to hedge against inflation due to its ability to retain value amidst falling economies based on past historical data. When Dollar weakens, it will most likely drive inflation rates up and cause Gold prices to spike. We can view Gold as an alternative currency to hedge against inflation in a broader sense.

Economic factors/events

Let’s take the recent Russia-Ukraine War as an example. Upon Russia’s invasion of Ukraine, Gold surged to a high of over US$2,000/oz right after the announcement of the Russian oil import ban by the United States. Investors had rushed and opted for Gold as a safe haven with the invasion and information, driving prices up as demand surged.

Demand and Supply

Gold is a highly coveted commodity that has been used for a variety of purposes such as consumer goods or industrial sectors such as Gold jewellery, dentistry, electronics and more. When the demand for these increases, the prices of Gold will rise; also, when there is a scarce supply, the prices will increase too. For example, if lesser Gold is mined and the amount of Gold is not sufficient to meet global demands, Gold will experience a surge in price. Therefore, demand and supply play a crucial role in determining Gold prices.

I hope you guys have a better understanding of the factors that affect the price movements of Precious Metals. You may also wonder why different Bullion dealers or platforms offer different spot prices. We have discussed this topic before, and you can read more about it here.

If you have any questions, please feel free to contact us to understand more. In the meantime, stay safe!

Evonne

Across the years, I have had the opportunity to come across many new investors looking to add Precious Metals into their portfolio. “Should I buy Gold or Silver? Or both?” This is a question that I hear frequently, and the answer really depends on what each individual is looking for. Let’s first discuss on the use of these two precious metals.

Gold is a Precious Metal that is well known for two key uses – a safe-haven metal, an alternative asset useful for portfolio diversification and as a main product used in the jewellery market. China and India, two of the largest market for physical Gold, have demand for the yellow metal throughout the year and experience a spurt in demand during festivals when it is their custom to gift Gold to their loved ones. The physical demand in these two markets provides support when Gold prices consolidate as jewellers tend to bargain hunt when Gold prices fall. On the other hand, while Silver receives some of the safe-haven flows, it is a metal that consists of industrial uses; hence the price movements for commodities do affect Silver too. Silver is the world’s best conductor and is therefore used in cars, solar technology, and many electronics.

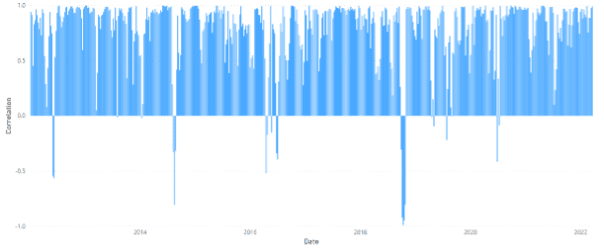

Despite the differences between the two metals, both metals’ prices share a robust positive correlation.

Throughout the last decade, there have only been a few instances when the correlation between the two metals fell into the negative zone. A positive correlation means that the prices for both metals tend to move in the same direction but to a different extent.

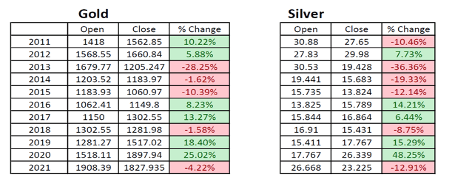

Here is the yearly performance for both metals for the last 10 years:

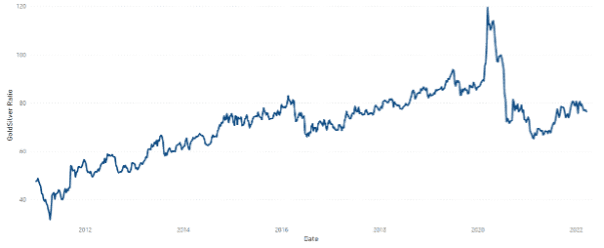

Lastly, to measure how Gold and Silver perform against each other, the Gold Silver Ratio will be a helpful tool to visualize this relationship.

As shown, the gap between the two precious metals was the narrowest during the week of 17th April 2011 at 31 before widening and eventually topping out at 119 during the peak of Covid-19 pandemic. It was during the pandemic that Gold received strong interest, while Silver did not receive the same extent of safe-haven flows in comparison. Inflation rates have been persistent, as commodities go on a strong rally. Silver has also been catching up with Gold at the same time, hovering near 75 presently.

Note, as this is a ratio, Gold against Silver, this ratio can go up in 4 scenarios if

- Gold goes up and Silver goes down.

- Gold goes up more than Silver goes up.

- Gold stays stagnant and Silver goes down.

- Gold goes up and Silver stays stagnant.

Vice Versa, the reverse for points 1 to 4 will be true for Gold Silver ratio when it goes down instead.

Investors have to determine which scenario it is that led to the higher or lower ratio and their objective for using this ratio.

Sin Pong

GOLDEN MOMENTS

Should you be wondering what is in-store for Daddy dearest on this very special Father’s Day, take a little time off to shop online with GoldSilver Central, just one click away!

https://www.goldsilvercentral.com.sg/shop/

Every celebratory occasion is a special experience. Most of the time, we put in utmost thought into buying a special gift for someone close to our hearts – the one who means a lot in our lives.

The most heartfelt gifts are the ones that truly take one by surprise and create that spontaneous smile in that special one’s face. Thoughtful gifting does not have to involve spending extra money or concocting an elaborate setup. It is in the seemingly simple action of being in sync with the thoughts of people whom you love and that induces the most heartwarming gifts and gestures.

GOLD

- makes an unbeatable impression when given to your loved ones.

- serves as wealth preservation.

- becomes a gift with heritage value.

You may ask, on what occasion does Gold make an appropriate gift? Traditionally, Gold bars and coins are given with congratulatory intentions for wedding, birthday or welcoming of newborns. There is no better start for a newlywed couple to receive Gold as a valuable form of savings for their future. Bestowing Gold on newborns is also popular. Even an annual affair in presenting these shiny bullion for Father’s Day is the best way to show your love for your father.

At GoldSilver Central, we are your one stop solution for all your Precious Metals Needs including gift ideas! Shop at GoldSilver Central today!

Connie

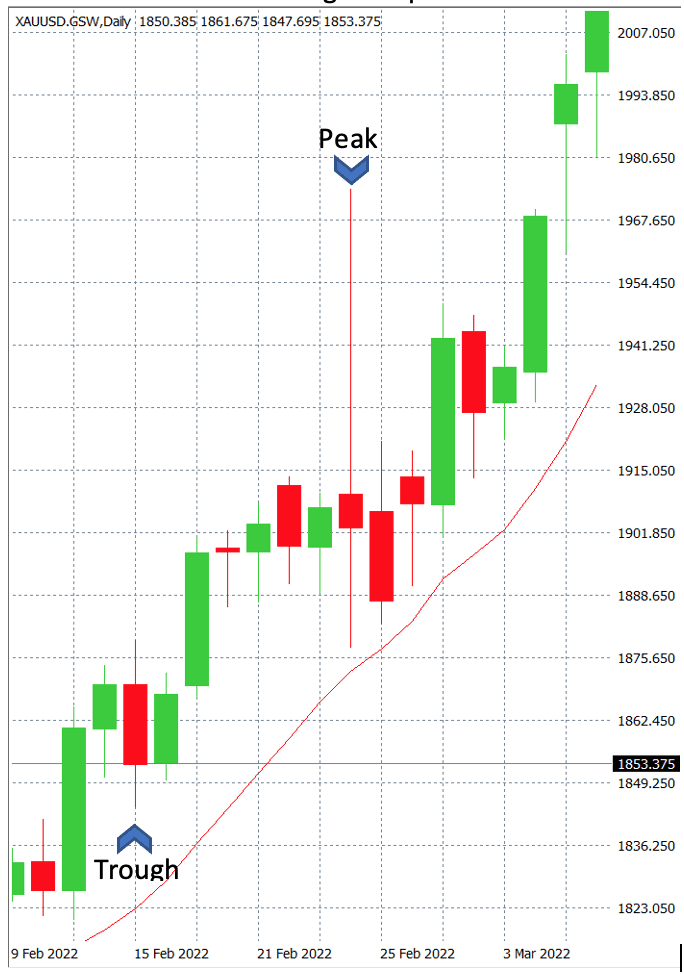

One of the most important information all investors would like to know is the prices trend. Prices have a propensity to move directional, forming a trend and trends likely to persist over time.

Peaks and troughs are pattern that are developed by the price movement. Trends are determined by a series of these patterns.

How can we determine the trendline has been broken or not? Witness the breakdown and then replacement of the peaks and troughs.

But be careful you do not make the mistake of using a time frame that is too short. Peaks and troughs are developed over weeks and months of price action, not hours and days of trading.

Daily candlestick is used in the chart for illustration. Each bar represents one day of price movement.

Below is the chart showing the uptrend.

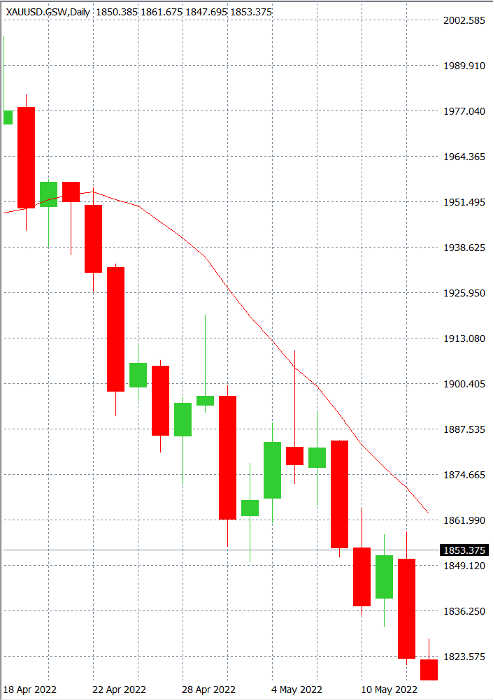

Below is the chart showing the downtrend.

Below is the chart showing the sideways (consolidation).

Suzane

I’ve recently been bombarded with new ideas and information, many of which I cannot digest immediately. There is one concept amongst all which I find interesting and would like to share with you. I believe that a large part of why people want to learn about investing involves dreams like improving their lives and achieving financial freedom. Who wouldn’t want to live and enjoy life without worries (such as living expenses, parental support, children’s tuition fees, etc.)? So, we learn to invest with hopes of improving our financial situation and preparing for the unknown future.

Today, I will not discuss which investment or Precious Metal is a better choice because we must recognize the more important point – to judge the market trend. If we can’t tell if the market is going up or down, we will not be able to decide whether to buy or sell no matter the kind of investment, agree? There is too much fake news being distributed amidst the real ones on the internet. Unlike senior economists and analysts who have the means to filter and analyze data from various sources to predict market trends, most of us cannot do it on our own. So, what can we do?

You might start to wonder if it will be great if there is an application that can tell you if the market is going to go up or down during a specific time frame and receive automatic reminders on price levels when it reaches your desired price level? With a “smart investment” application like this, many investment strategies can be simplified and automated, allowing us to spend our free time and energy on other meaningful activities in life, such as spending time with our family while making money. Would you be excited to try it if I told you we have an application on hand to make your journey in Precious Metals investment a little easier? We welcome you leave your contact details (click here) with us to learn more about how this application can change how you invest in Precious Metals.

最近我时常被各种新思想新资讯轰炸,很多都没办法立刻消化。可是当中有一个概念我觉得很有趣,希望可以分享给各位。首先,我相信大家想学习投资的理由很大部分和改善生活以及实现财务自由等梦想有关。谁不希望可以享受人生,无需担忧吃穿用度、供养父母、子女学费和退休生活呢?所以我们学习投资,希望可以改善自己的经济状况和为未知的将来做好准备。

今天我就不讨论哪种投资或哪个贵金属比较好,因为我们必须认清更重要的一点,那就是——判断市场趋势。无论是哪种投资,如果我们无法判断现在是上升还是下跌的市场,我们就无法决定到底是要买入还是卖出。同意吗?而网上太多消息真假混杂,我们大部分人不像资深经济学家、分析员等有办法从各方面的信息中筛选过滤分析数据来预测市场走向。那怎么办呢?

这时候我们可能会想如果有一个应用程式可以告诉我们接下来一个特定时间里市场是会上升或下跌,还可以自动提醒是否已经达到我们所要的价位,那该多好啊。有了这么一个“智能投资“应用程式,很多投资策略可以简单化、自动化,让我们赚钱之余可以把空出来的时间精力投入到人生其他有意义的活动中比如陪伴我们的家人。如果我告诉你我们手上就有这么一个应用程式,可以帮你在投资贵金属的旅程中走得轻松一些,你会为此兴奋跃跃欲试吗?欢迎你留下你的联络方式 (点击这里),和我们一起了解这个可能改变你如何投资贵金属的方案。

Maya

In our previous article on how to set price alerts to buy and sell on our website. Now, would you be interested to know more about setting price alerts using our platform (GSC Live!)? It is an awesome tool to help in setting price alerts for most of us who are always on our desk – alerts can only be set using the desktop version only. “How?” you wonder. Well, all our clients are entitled to a complimentary non-tradeable account to log in and view prices on GSC Live!.

To set price alerts, click into the “Alerts” tab, right click your mouse and start creating alerts and notifications! It’s amazing that you can even set an expiry date for the alert so that it will not notify you once it expires, even if it hit your desired level after the alert expires.

*Only the desktop application can set alerts and you have to be in the application to get notified when the alert triggers.

Wait a minute, what IF you missed the alert as you were caught up in an appointment, or the price level hit while you were sleeping? Don’t worry! Activate your account on GSC Live! to execute the orders for you by setting buy / sell limits. The difference between setting buy/sell limits and alert notifications is that the order will be executed immediately upon reaching your desired price level. If you prefer a simpler way of getting a price alert for your physical Gold, Silver or Platinum bar, you can also set it up via our website! I’ve shared this in my previous article and you can refer to it here! You will not have to worry about missing the notifications or alerts on your preferred price level anymore!

Speak with us to find out more about GSC Live! at 6222 9703 or email to gsclive@goldsilvercentral.com.sg.

Suzane

Since the Russia-Ukraine invasion, Gold experienced a magnificent roller coaster ride, and we witnessed a wave of physical gold holders selling their yellow metal to cash out at another historical high price of nearing US$2,040/oz. At the same time, investors and retail sales were outweighed by a jump in demand, led by a surge in new first-time buyers as prices hit new or near all-time highs against the world’s major currencies amid worsening inflation and Russia’s Invasion of Ukraine.

As global economics battle with the after tremors of Covid-19 in the form of inflation, Singapore’s annual inflation rate accelerated to 4.3% in February 2022 from 4.0% in the previous two months. As inflation runs rampant, what does that mean for us? Soaring prices for food, transport services, fuel, groceries, literally everything is pricier.

On the ground, we are witnessing an influx of buyers with the intent to hedge using both gold and silver bars. Interestingly, even with various agendas behind the buying spree, most buyers concurred that physical hedging is essential in times like this.

Do you think that gold is going to go up indefinitely? Probably not. You hold an asset in your portfolio as ballast, as downside protection. It doesn’t pay any dividends, much like bitcoin. You are not holding it for its lack of volatility through time.

Gold is said to stand for many things, and some widely misunderstand it as an actual store of value: protection of wealth. Its price can be argued as many things, but what it could stand for: an insurance policy. How much exactly are you insured in your portfolio?

Mindy

When it comes to Precious Metals investing, we often hear of well-known mints and refineries such as The Perth Mint, Argor-Heraeus, Austrian Mint, Pamp Suisse, Royal Canadian Mint and more. However, do you know what a mint and a refinery do? And what is the difference between them? Today, we will be sharing some basic but helpful information about them.

Mint

In simple terms, a mint is a factory where the bars and coins are produced. Most of the world’s leading mints, such as the Royal Canadian Mint, Austrian Mint, The Perth Mint and the US Mint, are state-owned, so they have the government’s consent to mint coins to be used as legal tender or national currencies. For example, the Canadian Maple Leaf Silver Coin 1oz has a monetized face value of 5 CAD (Canadian dollars), and the Austrian Philharmonic Gold Coin 1oz is worth 100 Euro.

Refinery

Mainly, the refinery is to refine the Precious Metals such as Gold, Silver and Platinum. The refinery process removes impurities, refines them, and produces them into investment grade bars and coins. Refineries can be from the industries such as mineral explorations, mining, jewellery business or scrap metal recycling.

Some of the well-known refineries in the precious metals industry are Argor-Heraeus, Pamp Suisse, Valcambi, Rand Refinery and more. We only carry bars from refiners who LBMA has accredited as meeting the exacting standards for trading on the global OTC (Over- The-Counter). You can check the LBMA accredited refinery list here.

GoldSilver Central has been an authorized and reputable bullion dealer in Singapore for 10 years. We carry a wide range of physical bullion from various LBMA accredited mints and refineries. In case you were wondering, we celebrated our 10th Anniversary last March! (Link to our 10th anniversary page). If you are interested in buying physical bullion, feel free to get in touch with us, and we will be more than happy to walk with you throughout your Precious Metals investing journey!

Evonne

Gold prices went above and beyond on the 8th and 9th of March 2022, before retracing back to levels below US $2,000/oz. Were you experiencing difficulties in reaching out to your dealers to transact, especially so when their phone lines were engaged? It’s always good to be able to transact anytime whenever the price is right, without the worry of whether the dealer is reachable. The Perth Distributor Depository Online (PMDDO) program is convenient when it comes to transacting! The program is also governed and guaranteed by the Western Australian government.

Let’s look at some of the benefits of investing under the PMDDO program, and why you should consider this program:

Benefits of Investing under the PMDDO Program

Some key benefits include being able to self-manage your physical Precious Metals (Gold, Silver, and Platinum) 24/7 and as the only government guaranteed (Western Australian government), you can also choose to trade in currencies such as the AUD or USD. A low minimum of AUD 50 is required to kickstart your journey with PMDDO, you can also choose allocated, unallocated or pool allocated storage options when you transact on the PMDDO platform.

Why Invest with The Perth Mint?

The Perth Mint is governed and owned by the government of Western Australian and have been refining Gold and other Precious Metals since 1899! The Perth Mint is also dedicated to ethically sourced Precious Metals with more than AUD 6 billion worth of Gold and Silver stored for more than 70,000 clients globally.

(Source: https://www.perthmint.com/invest/depository-online/)

Suzane

The recent war between Russia and Ukraine had far-reaching consequences for the international economy. Our friends in Russia and Ukraine had shared that their valuables (such as Gold) were confiscated by soldiers when they wanted to leave the country for asylum, resulting in them watching their hard-earned money being washed down the drain. However unbelievable, a heinous thing like that is actually happening in today’s world. Whether it is the war or the personal experiences of friends, we have a deeper understanding that investing in physical Precious Metals is not the only way to own Gold.

Perhaps many people have a specific understanding of non-physical Precious Metals investments such as CFD (contract for differences) Gold or Silver, Accumulation Programs, and ETFs (exchange-traded funds). But have you heard of the Perth Mint Certificate Program? In terms of credibility, this is the only government-guaranteed (Western Australia) program. In terms of flexibility, you can trade and withdraw physical Precious Metals any time! And in terms of threshold, the Perth Mint Depository Distributor Online account only require an amount as little as USD 50 to trade. Most importantly, there is no need to worry in times of uncertainty as the Certificate Program can only be traded by the Certificate owner, and no one can take the ownership of these Precious Metals from us.

If you are interested to find out more, please visit our website: https://www.goldsilvercentral.com.sg/perth-mint-depository-distributor-online-pmddo/

We also welcome you to make an appointment to discuss your Precious Metals investment needs with us: https://goldsilvercentral.setmore.com/bookappointment

That’s all for today, see you in our next article!

最近俄罗斯和乌克兰的战争对国际经济影响甚远。我们有一些在俄罗斯以及乌克兰的朋友甚至分享道当他们要从本国出境避难时,身上携带的值钱物品如黄金等都一律被士兵充公了。辛苦攒下的血汗钱就这么白白打了水漂。虽然难以置信但是如此令人发指的事情却真实发生了,无论是战争或朋友的亲身经历都让我们更深切的体会到投资实物贵金属并非拥有黄金的唯一方式。

或许有很多人对黄金或白银的差价合约、储蓄计划、ETF等非实物贵金属投资有一定的了解。那大家是否听说过珀斯铸币厂证书计划?论可信度,有一国政府(西澳大利亚州)的担保。论灵活度,可以随时变卖、提取实物贵金属。论门槛,此计划的线上户口最低只需要50美元就能交易。最重要的,是不需要担心发生如我们的朋友这般遗憾的事情。因为证书计划非本人是不能交易的,没有人可以从我们身上夺走这些贵金属的所有权。

有兴趣了解更多详情的话可以浏览我们的网站https://www.goldsilvercentral.com.sg/perth-mint-depository-distributor-online-pmddo/

我们也欢迎您预约时间来详谈您的投资需求https://goldsilvercentral.setmore.com/bookappointment

今天就到这里,我们下一篇文章见!

Maya

When the Gold price was hovering around the USD 2,000 per troy ounce(oz) levels, there were speculations that we may witness a repeat of the significant event back in 2011 that resulted in the end of the decade long bull run of Gold. It is worth mentioning a couple of the the contributing factors that differ then and now.

1. Inflation has been the talk of the town in 2011 with observable inflation readings.

Since the onset of the Russia-Ukraine conflict, the ripple effect is evident through the enhanced focus on ESG concerns and the impetus towards onshoring and energy market fragilities. All these weren’t in play back in 2011.

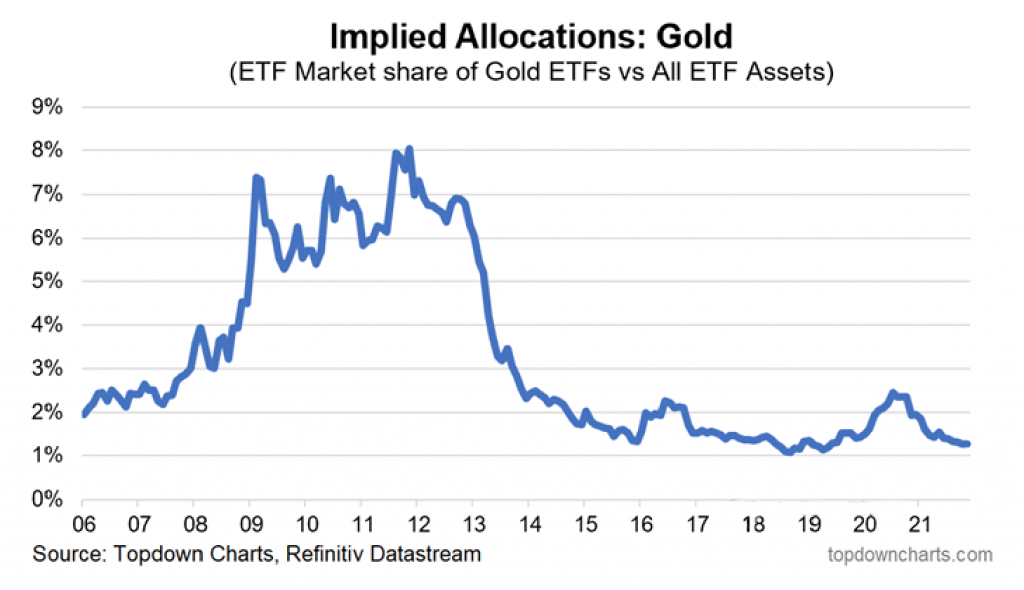

2. The exuberance towards yellow metal in 2011 versus the subdued sentiment this time round is clear from the following chart.

According to the Topdown Chart by Thomson Reuters, Gold ETFs versus the total ETF market is only at 2% in 2020, comparatively to 8% back in 2011.

In comparison to 2011, Gold is projected to be in a healthier position with inflationary dynamics more supportive of the precious metal in the current times.

The majority of the investors would concur that higher interest rates are an aversion to Gold. Commonly, it is anticipated that when the Central Banks ease monetary policy, the gold price tends to react positively, whilst the opposite tends to happen when there is an expectation of tighter Central Bank policy. Reality has proven to be much more complex due to the Russia-Ukraine conflict. Not only is Russia the second-largest producer of Gold, mining about 10% of the world’s new supply each year, but its Central Bank also holds an estimated $145 billion in Gold reserves. This creates a great deal of uncertainty about the short-term future of the gold market. Disrupted trade could lead to a shortage of available Gold internationally, pushing the prices up. On the other hand, the economic pressure of the sanctions on Russia could force Kremlin to liquidate its Gold in exchange for currency, this would flood the market with an estimate of 2,000 megatonne (MT) of Gold, equivalent to about two-thirds of the total worldwide Gold production of a typical year.

Without a clear resolution to the Russia-Ukraine conflict, there’s no telling when will the market return to a more stable state. Strong underlying inflationary pressures continue to be the main supportive fundamental factor driving the Gold price.

In times of uncertainty, people generally have the tendency to turn to precious metals as a hedge for the time being and avoid speculation. There’s a Chinese saying that says: “When there is a crisis, there is money to be made.” Which asset will you look to channel your funds to?

Mindy

“Should I buy a gold necklace or a gold bar?”

We are pretty sure that thought has come across your mind before. Should you choose to go for that pretty jewellery piece or should you choose to go for a plain looking gold bar?

Today, we shall take a very brief look at the main forms of Gold and consider the pros and cons of each. Namely the following forms:

- Jewellery

- Bullion Bars and Coins

- Pool Allocated Precious Metals

Although, we must say that there are no “right or wrong” or “one size fits all” kind of form. Anyone who tells you otherwise is simply pushing a product to you. Beware of that! As you will see in the below table, there are pros and cons to each form, and it depends on the individuals’ preferences and circumstances!

Perhaps, to aid your decision, we have thought of 3 questions which might guide you!

3 questions you should also ask before investing!

So which form do you prefer you Gold in?

Let us know in the comments below!

Jason

While the recent ongoing tensions between Russia and Ukraine raise the risks of a protracted conflict within Ukraine, the war also creates concerns about the potential impact on financial markets and the global economy. Besides increasing the likelihood of market volatility, the invasion is likely to add to inflationary pressures by disrupting exports of oil, natural gas, and wheat from Russia and Ukraine and raising prices.

The impacts of the conflict are likely to vary depending on geography. While that injects some uncertainty into the global outlook, the US economy appears relatively insulated from the war. For individual investors and consumers in the US, the effects will most likely include additional inflationary pressures due to higher energy prices. These also led to recent stock market volatility, reflecting various investor concerns and uncertainty.

When it comes to the planning of your investment portfolio, inflation can affect your choices in the long run as money depreciates over the years. By diversifying your portfolio into Gold and Silver will help mitigate your overall portfolio risk. It is worth noting that over the years, Gold had outperformed the rate of inflation. If you hold some Gold in your portfolio, your risk will be reduced by a considerable margin. Similarly for Silver, they can perform the same function as Gold as they are positively correlated.

There are a few ways to diversify your Precious Metals investment geographically. If you’ve plans to hand down your physical bullion as part of your legacy to future generations, you can consider storing them in our allocated storage program at the Le Freeport. Le Freeport is a tax-free zone in Singapore which makes the vicinity an ideal storage premise. We also offer storage services globally in Hong Kong, New York, London and Zurich..

We are also one of the distributors of the only Government Guaranteed Precious Metals Storage Program in the world – The Perth Mint Certificate Program. The Perth Mint Certificate Program offers 3 storage options: Allocated, Pooled Allocated and Unallocated.

All with the same Government Guarantee and is an excellent program for your geographical diversification. You never know when you need your offshore precious metals especially when we witness now what is happening in both Ukraine and Russia citizens.

Do connect with us at enquiry@goldsilvercentral.com.sg or WhatsApp us at +65 8893 9255 if you are keen to find out more about our Global Allocated Storage Program or the Perth Mint Certificate Program.

Joycelyn

Every investor is unique. The circumstances he/she faces at this stage in life, the mentality that he/she carries as well as his/her personal expectations. All these are different!

Hence, at GoldSilver Central, we firmly believe that no one product suits everyone’s needs. It is impossible. Chances are, customers end up investing in precious metals solutions that neither suit their needs and objectives and customers end up disappointed.

Here, we always ask any serious precious metals investor these 3 questions.

1. What is the purpose of this investment?

Are you looking to earn a quick profit? Did a “trusted friend” tell you that Gold prices are on the rise and you need to buy into Gold before its too late? If so, we suggest you take a pause and consider this question first before putting your money down.

It is important, because if you were to buy on someone’s advice, who would you listen to then if things do not go the way you expect it to? (take note there is no market that only trends upwards and never suffers pullbacks.) In those situations, would you try to “wait it out”, believing that prices would once again rise up and your investment would be vindicated? For those of us unfamiliar with Gold’s history, prices peaked in 2012 and remained low for the next eight years before reaching a new high in 2020. That is 8 long years to “hold on dear life”, much too long for a “trusted friend’s advice” in my humble opinion.

We would humbly suggest for you to consider instead, are you putting your money down with an eye for short term profits or long term asset allocation? If it is the former, what would your exit strategy then be? Are you looking to exit once the prices reach a certain level? If it is the latter, how much volatility are you prepared to take on in your portfolio?

These are areas which GoldSilver Central’s staff can discuss more and plan it out properly with you.

2. What is your timeframe?

Are you looking for a 1 week trade? Or a 5 year investment? If it is a shorter timeframe, you have to pay very close attention to details such as buy-sell spreads, premium costs, buyback discounts, etc. You have to know that paying a 20% premium for a silver bar, in the hopes that Silver prices rise by more than 20% (only for you to break-even) in a week would have a fairly low percentage chance of occurring. Not impossible, but improbable. If it is a longer timeframe, you then have more leeway to work with. You could employ strategies such as dollar cost averaging, wait for physical premiums to go lower, so on and so forth. That is why long term investors usually fare better than short term traders (and face lesser stress too).

3. What is your budget?

Do not misunderstand us when we put this question out there. Every investment sum is definitely a step in the right direction. What we mean by this question is this, if you are putting 10% of your portfolio into precious metals then yes, a proper thought process should be worked out. However, if you are looking to put in only 1% of your portfolio into precious metals, then is it really worth spending so much time and effort? Is it really worth spending hours negotiating numerous websites trying to save a few dollars of extra premiums? I would personally spend that few dollars and try to secure a dealer who is able to add value and think along the same lines of investments as me.

Of course, if you have a small monthly budget sum, that does not mean you cannot or should not plan properly. With tools such as GSC Live! and Goldblocx, you can buy Gold automatically daily for as low as $0.01! That definitely helps us in achieving our needs and objectives!

So that’s it. 3 simple and yet prudent questions which we feel should be asked before entering any investments. If you wish to discuss more, feel free to reach out to us via our GSC:Anywhere platform or just drop us a call!

Jason

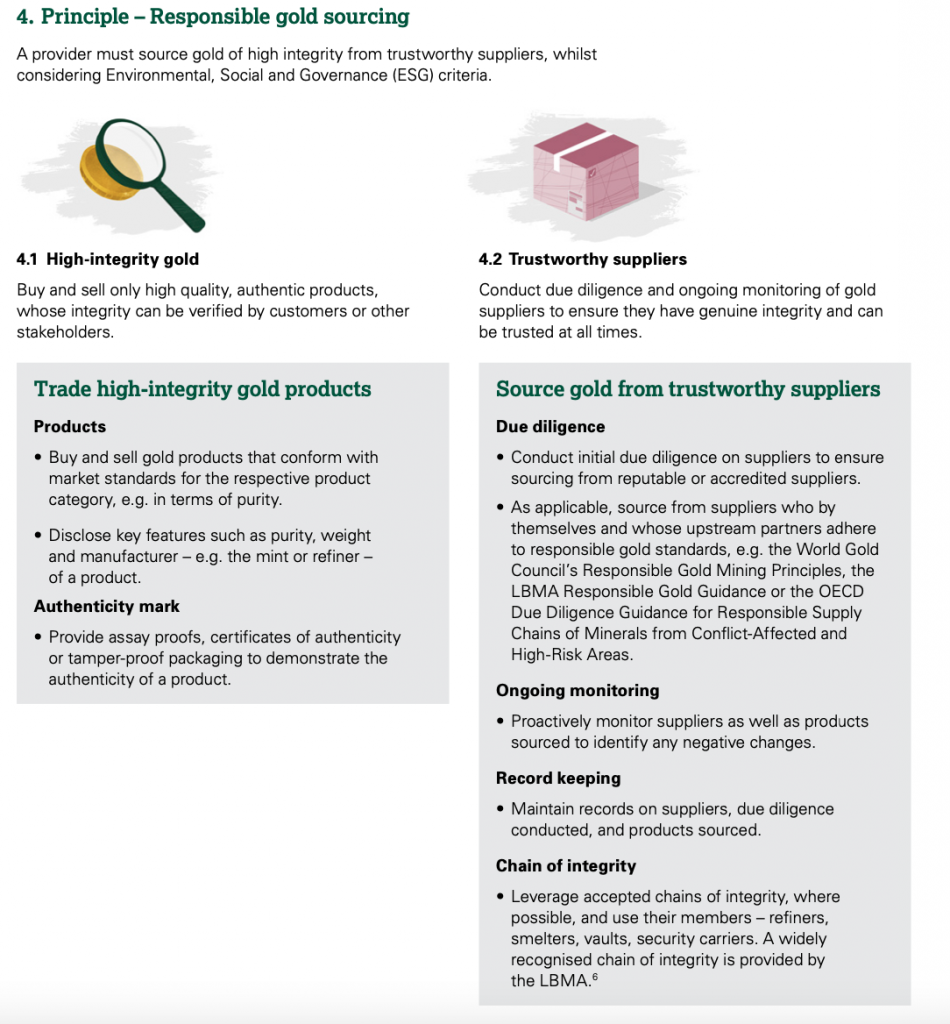

We have seen the letters “ESG” so much more than before. Now, ESG is the short form of Environmental and Social Governance. I’m sure the question has crossed your mind many times – what has the environment or being socially responsible got to do with me purchasing precious metals?! The main reason ESG is so important right now is that it helps mitigate risks for investors. What risks are involved since we are just purchasing maybe some Silver coins and Gold bars, right? Let’s take a broader view into the factors involved in ESG below:

(Source: https://retailinvestment.gold/en (World Gold Council – Provider Principles)

The factors listed to be following ESG greatly impacts our everyday lives, and imagine if you had purchased the items from a non-adherence organisation! What if child labourers mined the gold bars we purchased in bad working conditions and in a country filled with corruption and bribery, and the gold bar suddenly becomes non-LBMA accredited? What would you do with the gold bar? It is always important for consumers like ourselves to check on the accreditations a Bullion Dealer holds and the various hallmarks carried by the dealer to safeguard and be at ease when purchasing.

At GoldSilver Central, we are a current local associate corporate member of the Singapore Bullion Market Association (SBMA) and carry a wide range of physical precious metals products (LBMA-accredited). We are also one of the Regulated Dealers registered under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 (“PSPM Act”). With these, you can be assured that all our products follow ESG guidelines as we continue to move towards impact investing and being socially responsible.

We look forward to meeting you in our retail store soon!

Wendy

English version

In our previous article, I’ve mentioned that my personal recommendation for a newbie investing in precious metals is to invest and purchase in Gold. I’m sure you’ve heard that Silver has been trending recently, leading you to be hesitant on whether you should be choosing Gold or Silver, right? Today, we will be analyzing and comparing these two precious metals so that everyone can choose the investment they think is worthwhile.

We previously discussed that Gold has two key points – Liquidity and Buy/Sell Spread, which is in line with the needs of a newbie investor. In fact, I personally think that these two points are factors that must be considered in any kind of investment, not just for precious metals.

In terms of Liquidity, we’ve seen an improvement in Silver for the last 10 years. Although Silver is considered to be slightly inferior as compared to Gold, most dealers and a small number of pawnshops have accepted trading Silver (note: Silver here refers to investment grade Silver, which excludes Sterling Silver, 925 Silver jewellery, silverware, etc.). The Buy/Sell Spread on the other hand, increased from the usual 10% to between 15 – 20% due to a series of events (temporary supply chain paralysis caused by Covid-19, #SilverSqueeze by the Reddit Community, etc.). Dealers had to increase the price of Silver products accordingly as many mints and refineries increased their premiums due to supply shortages.

Having said that, let’s look at what other advantages Silver have over Gold. Personally, I think that affordability is the biggest advantage of Silver. Let’s take the most common hallmark coin – Canadian Maple Leaf One Ounce Gold and Silver coins as an example. The current price of the Gold coin can purchase 68pcs of the Silver coin. Just imagine, what happens if both Gold and Silver price rise by $10/oz? Well, the 68 pieces of Silver coins you bought would be more valuable than 1 Gold coin (note: we must also consider that the actual price increase of Gold and Silver are usually different, and this is just an analogy). It is precisely that because Silver is cheaper, its Upside Potential is also greater as it holds a higher value when holdings increase. The price of Gold as of 10 Mar 2022 15:45PM Singapore Time is USD 1,978.50/oz, and the price of Silver is at USD 25.50/oz (oz=troy ounce, pronounced as “aʊns, and is equivalent to 31.1035 grams). In August 2020, Gold hit an all-time high at USD 2,074.96/oz, whereas Silver’s all-time high was USD 49.45/oz in 1980. In terms of probability, I personally think that chances are higher that Silver’s price will double rather than Gold doubling its price.

By now, you must be wondering why wasn’t Platinum mentioned in my article? I’d say take it slow and not to rush as we should always learn things step-by-step. (In fact, I had to squeeze my brains and leave some topics to write for in the long-term when writing a manuscript. Thanks in advance for not blowing my cover!)

I will stop here for now, see you in our next article! If you’ve any questions, please feel free to leave a comment and we can discuss together.

Maya

中文版本

上期我们说到作为新手,我个人比较推荐买入黄金作为你第一块打开投资贵金属大门的敲门砖。可是相信你们还是会听说过最近白银很大势喔所以在犹豫到底选择哪一个比较好对吧?那么我们今天就来分析比较一下两者好让大家可以选到自己认为值得的投资。

之前我们说到黄金有两个特点我觉得是契合新手投资的需求的,那就是流动性(liquidity)和买卖差价率(buy/sell spread)。其实我觉得这两点是任何一种投资都得要考虑的因素,不单单只是适用于贵金属投资。

首先就流动性而言,白银在近10年的流动性已经改善了许多。虽然比起黄金还是稍微逊色了一些,可是大部分的经销商和少部分的当铺都已接受买卖白银(请注意这里的白银是普遍指投资用的白银,不包括sterling silver, 925银饰或银器等)。至于白银的买卖差价率则因为新型冠状病毒肺炎造成的短暂供应链瘫痪以及红迪(Reddit)用户挤压金属供应等一系列事件从往常的10%左右增加至15-20%。这是由于供不应求而造成很多铸币厂和精炼厂把手工费(premium)提高,经销商唯有跟着调高白银产品的售价。

说了以上两点,让我们来看看白银比起黄金有什么其他优势吧。我个人认为便宜是白银的最大优势,以最普遍的加拿大枫叶一盎司金币和银币来举例的话,目前一个金币的价格可以买68个银币。设想如果金价和银价同时都上涨10元,那你买的68个银币带给你的增值就会比1个金币来得多(当然也要考虑现实金价和银价的涨幅通常是不一样的,这里只是做一个简单的比喻)。也正因为白银便宜,所以它的上涨潜力比起黄金是大很多的而且因持有数量带来的增值也比较多。截至2022年3月10日新加坡时间15点45分,金价是美元1978.50/oz而银价是美元25.50/oz (盎司oz=troy ounce,读作”auns”。等于31.1035克)。2020年8月金价达到了历史以来最高的记录美元2074.96/oz,而银价的最高纪录则是在1980年达到49.45/oz。以可能性来说,我个人认为银价会翻倍的几率比金价来的高。

你说怎么没谈到铂金?慢慢来别急,学习总得要有个循次渐进(其实是我写稿也要挤挤脑汁留点话题才能写长远,请别当面拆穿我小女万分感激)。

今天暂时就分享到这里,我们下回见!有什么疑问欢迎在我们的留言区讨论哦。

Maya

Introduction

Numismatics are often associated with being coins that are both rare and ancient. The value of numismatics goes beyond its currency because of their significance and unique historical values.

This article focuses on the extended knowledge of numismatics.

Coin Grading

The Sheldon Scale was introduced by Dr. William Sheldon, a renowned numismatist in 1948. The Sheldon Scale is now internationally recognized and used widely in the coins and numismatics industry. It is a point system scale, ranking coins from a scale of 1 to 70. The higher the grade, the better the condition of the coin is. To account for a wider range of coins, the Sheldon Scale had been modified. Below are the grades and explanations:

MS/PR-70 (Mint State/Proof): A coin with no post-production imperfections at 5x magnification.

MS/PR-69: A fully struck coin with nearly imperceptible imperfections.

MS/PR-68: Very sharply struck with only minuscule imperfections.

MS/PR-67: Sharply struck with only a few imperfections.

MS/PR-66: Very well struck with minimal marks and hairlines.

MS/PR-65: Well struck with moderate marks or hairlines.

MS/PR-64: Average or better strike with several obvious marks, hairlines and other minuscule imperfections.

MS/PR-63: Slightly weak or average strike with moderate abrasions and hairlines of varying sizes.

MS/PR-62: Slightly weak or average strike with no trace of wear. More or larger abrasions than an MS/PF-63.

MS/PR-61: Weak or average strike with no trace of wear. More marks and/or multiple large abrasions.

MS/PR-60: Weak or average strike with no trace of wear. Numerous abrasions, hairlines and/or large marks.

AU-58 (About Uncirculated): Slight wear on the highest points of the design. Full details.

AU-55: Slight wear on less than 50% of the design. Full details.

AU-53: Slight wear on more than 50% of the design. Full details, except for very minor softness on the high points.

AU-50: Slight wear on more than 50% of the design. Full details, except for minor softness on the high points.

XF-45 (Extremely Fine): Complete details with minor wear on some of the high points.

XF-40: Complete details with minor wear on most of the high points.

VF-35 (Very Fine): Complete details with wear on all the high points.

VF-30: Nearly complete details with moderate softness on the design areas.

VF-25: Nearly complete details with more softness on the design areas.

VF-20:Moderate design detail with sharp letters and digits.

F-15 (Fine): Recessed areas show slight softness. Letters and digits are sharp.

F-12: Recessed areas show more softness. Letters and digits are sharp.

VG-10 (Very Good): Wear throughout the design. Letters and digits show softness.

VG-8: Wear throughout the design. Letters and digits show more softness.

G-6 (Good): Peripheral letters and digits are full. Rims are sharp.

G-4: Peripheral letters and digits are nearly full. Rims exhibit wear.

AG-3 (About Good): Most letters and digits are readable. Rims are worn into the fields.

FR-2 (Fair): Some details are visible. Rims are barely visible.

PO-1 (Poor): Enough detail to identify the coin’s date and type. Rims are flat or nearly flat.

Ungradable: Date and mintmark of the coin are undetectable, which is necessary for grading.

Coin Grading Organization

If you are looking to get your coins professionally graded, you may want to consider visiting reputable and well known coin grading companies like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Corporation) to get the coins graded. Graded coins will be certified as authentic, protected and held with a holder, and can be sold for a higher value to coin collectors or dealers who are willing to pay higher premiums for a relatively rare coin.

Numismatics vs Bullion