Last week, as part of our Storage month highlights, we looked at one single important reason on why you should own a Storage Account.

Today, we shall look at GoldSilver Central Storage program fees and understand what you are paying for as a Storage Customer.

GoldSilver Central’s Bullion Storage Program has been around since 2012 and has continued to serve our clients well. Located at Changi Le Freeport, a tax-free zone in Singapore, it is now considered amongst the safest area in Singapore.

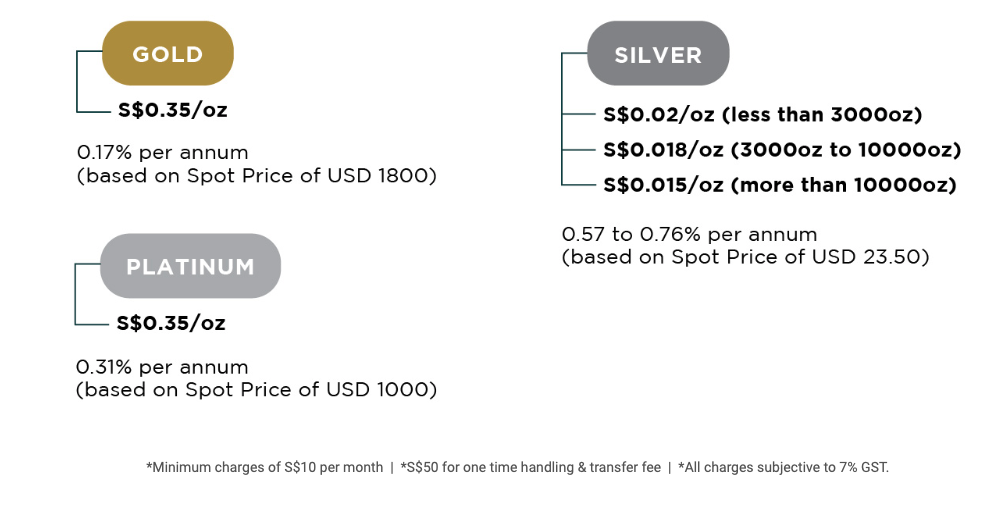

Below is our Storage Fees Structure:

A question you might have is, what exactly are you paying for?

- Security and Insurance

We know we’ve been saying that your holdings are stored in a secured facility. How secure is it exactly then? For starters, the physical compound is surrounded by concrete walls between steel plates and there are CCTV systems in place. The building facility is maintained by a central Freeport Authority and each vault operator within Changi Le Freeport has their own security system according to their design specs.

What this means is that in order to access your holdings, we would have to go past at least two levels of independent checks. GoldSilver Central also ensure that we work together with LBMA vault operators which adds another level of checks to our clients’ holdings. This also means that vault operators are able to fully insure your holdings due to the high level of security and stringent procedures.

This is the key difference compared to storing your holdings at a location such as your home safe.

No doubt, your home safe would be more easily accessible compared to GSC’s vault storage. However, we do need to consider what happens after you physically access your holdings? (You would still have to find a bullion dealer to sell it to you.)

Which brings us to our next point

Administrative and Convenience costs

GoldSilver Central Storage Clients have the option of being able to sell their holdings anytime they wish to. This can be achieved via our “DIY mobile platform”, GSC Live!. Storage clients have the option of being able to set sell limits or sell outright via GSC Live! and the fund proceeds can be transferred to your bank account after.

Good news is, there’s no need for you to fly into Singapore to transact or to reach an actual human staff at GSC to sell your holdings (You can sell it whenever you wish to.)

Also, if you are already storing your holdings at an external deposit box or a secured warehouse, we would like to propose you consider GSC Storage program as well. Ultimately, wherever you are storing your holdings, I would personally look at it as a potential investment in a partner (if you store it at home, then your partner is yourself!) that could assist you in your precious metals investment. And GoldSilver Central can help you to decrease your risks.

Perhaps a good question to guide you in your considerations would be:

Will the benefits of having a GSC Storage account offset the low costs?

At the end of the day, a wise man once said:

“Price is what you pay, value is what you get.”

If after reading this article, if you wish to speak with GoldSilver Central to see exactly how we fit into your financial planning, let us know. We are honored to be part of your precious metals journey.

Jason

GoldSilver Central’s Bullion Storage Program created since 2012 has continued to serve our clients very well. Located at Changi Le Freeport, a tax-free zone in Singapore, it is now considered amongst the safest area in Singapore.

Today, as part of our Storage month highlights, we shall highlight one important reason to have a Storage Account

Better manage your risks.

We know that proper management of risks is important in building your wealth portfolio.

Major unforeseen events like Covid-19 should give us a renewed respect for unpredictable catastrophic events and its possible impacts on our portfolio. For instance, a client who lives in Malaysia declines to store his precious metals in Singapore and instead stores it at his home safe, as he can cross over to Singapore very quickly if he ever needs to sell his holdings. Covid-19 hits and suddenly countries are on lockdown and borders are closed. Good luck trying to travel across to sell your precious metals. That is not going to happen.

Also consider a situation where a black swan event occurs and silver prices are skyrocketing, the market is going into a frenzy, and you are keen to bring your silver holdings into a bullion dealer for a valuation and sellback. Chances are the majority of the market will be looking to do the same thing and you suddenly find yourself jostling amongst others and trying to sell your silver at the highest possible price before the prices drop. Again, throw in Covid-19 into the above situation when many countries went into lockdown, and you could not even travel outside your home for non-essential purposes. (I may be wrong, but I highly doubt “I have to sell my silver before prices drop again” will pass as an essential purpose in the eyes of the law.)

During these times, you can clearly see the benefits that having your precious metals holdings stored with a trustworthy and reputable dealer like GoldSilver Central. For your reference, no storage customers of GoldSilver Central faced any issues in their transactions with us even as they are unable to travel due to Covid19 restrictions.

GoldSilver Central has built up an intensive network of trusted and international partners over the years. By building up such an extensive network, we can ensure constant liquidity, regardless of market conditions. Also, we are better positioned to negotiate with refineries and to buy / sell excess in the market compared to an individual investor looking for a single sell transaction. May I take this chance to also add that we have our GSC Live! Platform where clients can lock in their buy/sell prices on their physical precious metals on their own mobiles, instead of having to try calling in to GSC together with the hordes of people who probably have the same intention to try and sell their precious metals then.

That’s it for today, we’ve explored one of the reasons of having a Storage Account with GoldSilver Central. In our next article special, we’ll dive deeper into the fees of the Storage Account. Till then, stay safe!

(If I may just add a personal plug, for investors interested to understand more about “black swan events”, read <<The Black Swan by Nassim Taleb>>)

Jason

One of our team members went to Korea and took this photo recently. For those of us unfamiliar, this is a love lock that lovers typically lock onto a public fixture (Most common a bridge or wall of sorts) to symbolize their love for each other. The key is supposedly then thrown away and their love is “unbreakable”. (Probably the author did not account for irate authorities or lock-picking thieves when he came up with this)

This Valentine’s day, we decided to explore why some people choose to “lock” their precious metals in a vault, whereas others just choose to leave them at home. What is the difference between a safety deposit box, a vault and my home safe anyway? Aren’t they all just places to store items safely? Today, we will head into the realm of vaulting security.

Home Safe

A metal safe box at your house where you apparently store your important papers under your personal name (Think title deeds, birth certificates, cash, etc.), all in the hopes that a burglar who breaks into your house will not find it/ deems it too troublesome to cart off a neatly packaged “takeaway container” of the things he came in to find in the first place. We jest, but you get the idea:)

PS: We must take this chance to state that we are very fortunate to reside in a safe country like Singapore.

Safety Deposit Box

A slight improvement from a home safe system where you place the actual metal box at a third party facility with security protocols implemented. Costs are incurred for the security personnel and the technology but are typically low across the industry. Privacy levels differ at different facilities but a general trend is the higher the level of privacy you require, the higher the annual costs. Insurance of your holdings is typically not available.

LBMA Network Vaults

The vault is maintained by an independent LBMA vault operator who follows international standards and have strict security protocols. Financial institutions typically store their holdings within these secure facilities and form an ecosystem that enables global liquidity management and easy location swaps. LBMA vaults perform an important role in providing secure locations where bullion transactions between bullion dealers are facilitated efficiently. 100% insurance coverage is provided and high levels of check and balances are maintained.

At GSC’s partner’s vault, whenever a GSC staff enters the vault, they are accompanied everywhere by a vault operator and the same security protocols for visitors apply to GSC staff as well. Any deposit and withdrawal of holdings is strictly controlled and holdings are inspected regularly to ensure accuracy and security

Click here to find out more information on LBMA vaults.

Private Vault

Similar to the combined concept of an LBMA vault operator and a safety deposit box system, but under a private vault operator who sets his own standards and might not prescribe to international standards. Such operators usually act alone (due to clients’ privacy) and are not connected to other ecosystems. Stored physical bullion typically have to be transported externally before transactions can occur. Counter party risk might be high depending on the solvency of the vault operator. Unfortunately, there have been known cases of operators absconding with their client’s assets.

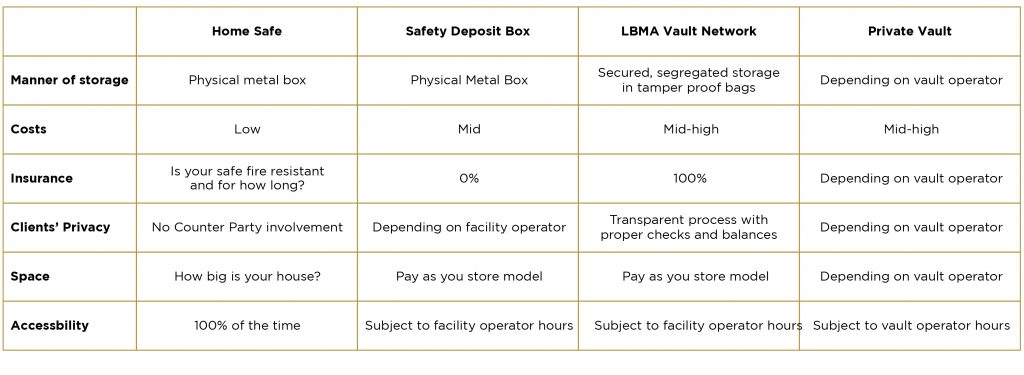

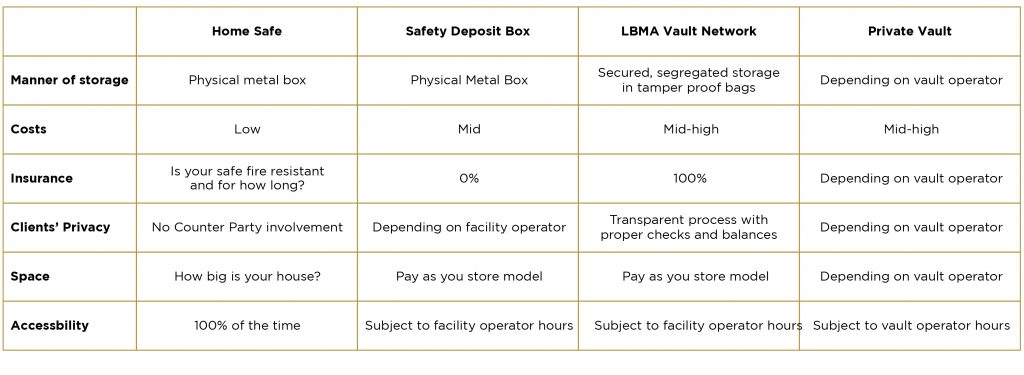

Quick Comparison of Storage methods

In a nutshell, it really depends on the clients’ needs and objectives! Different clients have different risk profiles and prioritize certain aspects of their portfolios over other factors. Speak to our Storage team for a more in depth analysis of your profile and portfolio to have a better idea.

So that’s it, a quick look at vaulting security. Keep in tune as we continue our updates, to make precious metals investing a transparent one.

PS: A quick shout out to GSC’s Storage Programme. We partner LBMA vault operators and seek to add value to our clients’ storage holdings.

Here’s how clients can maximize their holdings’ value:

- Instant Price Fix – Storage clients are able to phone in during office hours to sell their holdings instantaneously, regardless of their physical location.

- Live Valuation – When within GSC Vault Network, storage clients’ holdings are tracked with real-time prices, providing them a live valuation and profit/loss statement of their investment portfolio at any instance.

- Hassle-Free Administration – Clients do not have to worry about counting and keeping track how many pieces of each item they have. GSC sends a monthly statement with their item breakdown.

- Smart Analysis – Based on aggregated databases, we are able to optimize clients’ precious metals portfolio to achieve their objectives via portfolio rebalancing

Contact us at Storage@goldsilvercentral.com.sg or call us at +6562229703 if you are looking to maximize your precious metals potential.