Investing is a means many use to grow their wealth. If you’re currently reading this article, chances are that you would like to grow your wealth through investing too. Amongst the various investment options, precious metals have been proven to be a reliable choice over time. Here are 5 benefits of investing in precious metals:

Precious Metals Provide A Safe Haven During Times Of Market Volatility

Financial markets are affected by many variables such as economic downturns and political instability. Although there are anomalous events, precious metals have generally been proven to retain value through times of inflation. This is why you would hear people say that precious metals are go-to safe haven investments. In order to buffer your investment portfolio against market volatility, you may want to consider including precious metals in your investment portfolio.

Helps You Manage Portfolio Risk

When it comes to investing, diversification is key. By spreading your investments across different asset classes, you can minimize your exposure to risk. Investing in precious metals such as gold, silver and platinum offer a unique opportunity for diversification. Historically,these metals have shown a low correlation with traditional financial assets like stocks and bonds. During times of market turbulence, precious metals tend to retain their value. In some cases, their value even appreciates during volatile times, serving as a hedge against market volatility.

Preserving Your Wealth

Preserving your hard-earned wealth is just as important as building your wealth. Investing in precious metals is one of the few ways in which you can preserve your wealth. Unlike paper currencies, which can lose value due to political or economic instability, precious metals have been proven to be a lasting store of value. Through different historical events, precious metals have maintained their intrinsic value. They have also served as recognized forms of currency, providing tangible means to preserve wealth. Such characteristics are what makes precious metals an attractive option for long-term investment.

Buffering Against Inflation (Most Of The Time)

Inflation can erode the purchasing power of fiat currencies, making it crucial to find assets that can counteract inflationary pressures. Precious metals are widely regarded as a reliable hedge against inflation. As general prices rise, the value of precious metals tends to rise as well. This is due to their scarcity and inherent value, making them desirable during periods of increasing prices. While gold is often seen as a hedge against inflation, it’s important to note that its performance may vary in different inflationary periods. Diversifying your portfolio can help mitigate investment risks and maximize potential returns.

Portfolio Allocation

Maintaining a well-balanced and diversified investment portfolio requires proper asset allocation. Including precious metals in your portfolio can enhance its overall performance. Precious metals possess unique characteristics and behave differently from traditional financial assets. When other investments like stocks or bonds experience a downturn, the value of precious metals can rise, offsetting potential losses. Allocating a portion of your portfolio to precious metals can reduce volatility and improve risk-adjusted returns.

Conclusion

In conclusion, investing in precious metals offers a range of benefits for individuals looking to grow and preserve their wealth. Investing in precious metals provides you with an opportunity to diversify your portfolio. Precious metals investments help to mitigate portfolio risks as historically, they have shown a low correlation with traditional financial assets. By including precious metals in your portfolio, you can enhance your portfolio performance and reduce volatility. Ultimately, what you choose to invest in is dependent on your investment goals and strategy.

Discover a Smarter Way to Invest in Precious Metals with GSC Live! Seamlessly Buy and Sell Gold, Silver, and Platinum Online. Don’t Miss Out – Start Your Journey Today!

It is common to mistake platinum for white gold due to their silvery white appearance. But they are distinguishable by their weight as platinum is 20% denser, weighing heavier than white gold. Scoring 3.5 on the Mohs scale, Platinum is harder than gold and more costly to produce. About 30 times rarer than gold, occurring at very low concentrations in the earth’s crust. Often the preferred choice of jewellery especially for couples as it symbolises strength, durability and endurance.

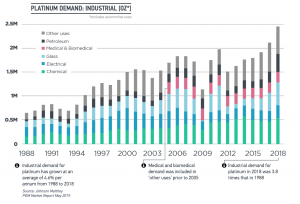

The automotive sector has the highest demand for Platinum. The metal’s active properties act as filters within catalytic converters of motor cars, helping to reduce harmful emissions. And because it does not react negatively to body tissue, they are considered biologically compatible metal and is used widely in hospitals for surgical instruments and implants. According to reports from World Platinum Investment Council, industrial demand for the metal are seeing an average 4.6% growth per annum from 1988 to 2019.

In the last 20 years, platinum reached its peak of $2,2253/oz in March 2008 and lowest of $785/oz in 2019. Interestingly, platinum backed investment jumped in the year 2019 particularly huge purchases in ETFs by large institutional investors. This maybe a hint to the market that corporate investors are speculating growth potentials. Perhaps it is time to consider diversifying your gold portfolio by buying some precious platinum.

But regardless if you are an investor looking to ride the platinum wave, a collector of platinum coins or diversify of your portfolio, GoldSilver Central is the one-stop solution that you need. Check out our website or drop-by our storefront and speak to our friendly staff. GoldSilver Central have an array of platinum bars and coins to meet your needs.

The answer is yes.

And not only just Gold; Silver, Platinum and Palladium bullion are safe haven assets as well. During turbulent times such as rising geopolitical tensions in key countries, investors are inclined to seek these metals for their financial portfolio.

Recently, a paper done by Dr. Brian Lucey and Dr. Sile Li from the Trinity Business School was published and examined the following topic: “Reassessing the Role of Precious Metals as Safe Havens – What Color is Your Haven and Why?”. The results?

This article extends previous literature and examines time varying safe haven properties versus equities and bonds of four precious metals (gold, silver, platinum and palladium) across eleven countries. Results suggest that the metals each play safe haven roles; there are times when one metal is not while another may be a safe haven against an asset.”

In sum, precious metals provided protection at different times across countries. No precious metal provides safe haven status consistently, over time or across asset classes. Strong safe haven status is rare. (Li, Sile and Lucey, Brian M. 2017)

To read the full article, please click here.

Li, Sile and Lucey, Brian M., Reassessing the Role of Precious Metals as Safe Havens – What Colour is Your Haven and Why? (February 8, 2017). Available at SSRN: https://ssrn.com/abstract=2906707 or http://dx.doi.org/10.2139/ssrn.2906707

2017 looks to be marked by uncertainty as what we’ve come to know as the “new normal” gets disrupted again. At a time when people are losing faith in political systems, precious metals now have a chance to play their unique role as safe haven investments. For those who observe cycles, the timing couldn’t be better as gold, having peaked around $1,920/oz in 2011, looks set to swing out of the low of $1,045/oz seen in 2015.

Through this time, we at GoldSilver Central have seen steady, robust demand for physical bars and coins in gold, silver and platinum. Singapore has a pro-business environment stemming from pragmatic regulation and close collaboration between government and industry. Operating out of such an economically sound and financially stable jurisdiction allows us to focus on creating the best products to meet all your precious metals investing needs. As the premier precious metals hub in Asia, the appetite for buying physical gold, silver and platinum from Singapore and the demand for storage of these products remains strong.

GSC Live!

GSC Live!, the world’s first (and probably still the only) spot physical deliverable precious metals product was launched in July 2016 on the popular MetaTrader4 (MT4) platform. You can now instantly buy and sell physical precious metals at real-time spot prices whenever you want with fully deliverable gold, silver and platinum contracts on GSC Live!. The MT4 platform also lets you buy into or sell out of your precious metals holdings. Our customers who have been seeking transparent, live streaming physical precious metals prices have been delighted by the straight-through processing capabilities and neutral real-time pricing of GSC Live!. Take charge of your gold, silver and platinum holdings and investments because where technology meets precious metals investing, the possibilities are endless.

After the success of GSC Live!, GoldSilver Central is excited to introduce its latest product offering – GoldSilver Central’s Savings Accumulation Program.

GSC Savings Accumulation Program

Grow your savings through physical Gold, Silver and Platinum

As the name suggests, this is a savings and accumulation product that allows you to acquire physical gold, silver and/or platinum in a gradual, cost-efficient manner. The use of dollar cost averaging allows you to buy precious metals at regular intervals at a fixed amount in dollars, regardless of the current price of gold, silver and/or platinum. Everything is automated and at the end of the savings cycle, the coins or bars that have been accumulated are yours to keep. Why stop at coins and bars? Going forward, we’ll add gold jewellery and other gold items to the product mix for you to take home or even to wear.