Preview of full Precious Metals Bullion Insights Report

To receive the full report of our Precious Metals Bullion Insights on a weekly basis, please subscribe here:

(We promise there will be no spam but informative insights from our in-house technical analyst team!)

PRECIOUS METALS MARKET REVIEW.

| Weekly Spot Price (30 April – 4 May 2018) | ||||

| Open | High | Low | Close | |

| Gold | 1322.47 | 1325.40 | 1301.37 | 1312.91 |

| Silver | 16.50 | 16.58 | 16.04 | 16.46 |

| Platinum | 911.45 | 919.18 | 908.27 | 914.19 |

Precious Metals News Updates:

| · | Exclusive: World’s biggest gold ETF launching new low-fee fund –source The World Gold Council, owner of the world’s largest gold-backed exchange traded fund (ETF), is launching a new fund with a cut-price management fee to fend off rivals with lower charges, a source familiar with the matter told Reuters. |

| · | · Lebanon Central Bank Governor on Elections, Reforms, Gold Lebanon Central Bank Governor Riad Salame discusses the Lebanese elections, structural reforms, financial engineering, protection of the peg and his outlook for gold. |

| · | Inflation Trade: Gold Lags, Silver Leads As Expected If an inflationary phase took root last week, the expected happened as silver took over leadership from gold. However, the trend in Silver/Gold is still down and until that changes some caution about an inflationary party atmosphere is warranted. |

| · | LAWRIE WILLIAMS: Chinese gold demand way up in April Indeed April 2018 gold withdrawals were comfortably higher than those in April 2015 too, but in the latter year gold withdrawals out of the SGE were particularly strong in the second half of the year and totalled almost 2,600 tonnes for the full year – around 80% of total global new mined production. |

Economic figures to monitor this week:

| Day & Date | Economic Events | |

| Monday, 7/5/2018 | Retail Sales (MoM) (Mar) (AU) | |

| Tuesday, 8/5/2018 | Fed Chair Powell Speaks (US)

JOLTs Job Openings (US) |

|

| Wednesday, 9/5/2018 | PPI (MoM) (Apr) (US)

Crude Oil Inventories (US) |

|

| Thursday, 10/5/2018 | Manufacturing Production (MoM) (UK)

BoE Inflation Report (UK) BoE Interest Rate Decision (May) (UK) Core CPI (MoM) (Apr) |

|

| Friday, 11/5/2018 | ECB President Draghi Speaks (EUR) |

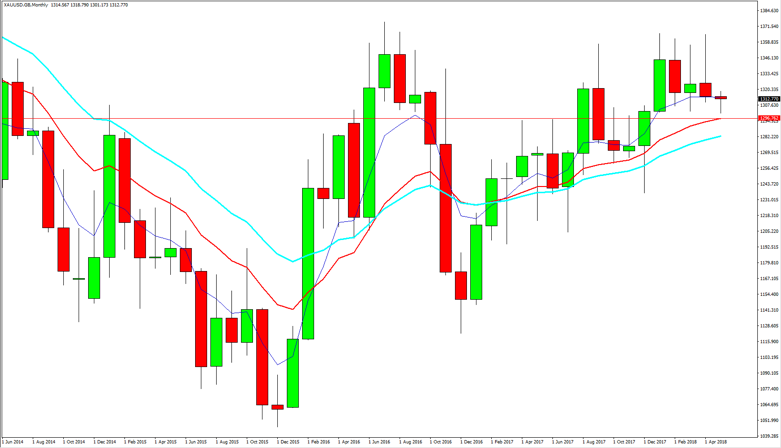

TECHNICAL ANALYSIS.

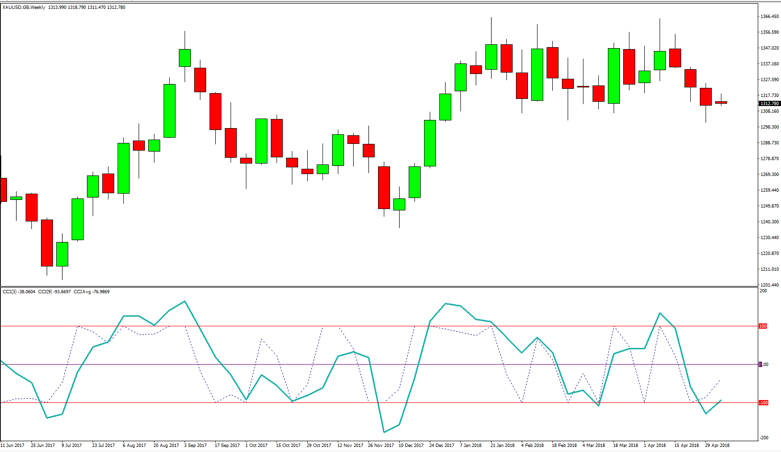

| Current Market mode*: Cyclical (as defined by daily ADX) | ||

| Weekly Short Term Outlook: Downward Bias (as defined by weekly CCI Indicators) | ||

|

Short term cyclical indicators show a downward bias for the week as CCI (3) and (9) are hovering below the -100 level. | |

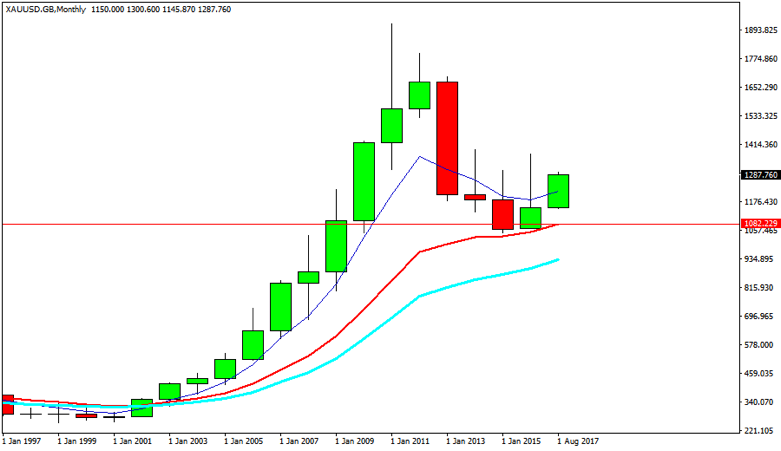

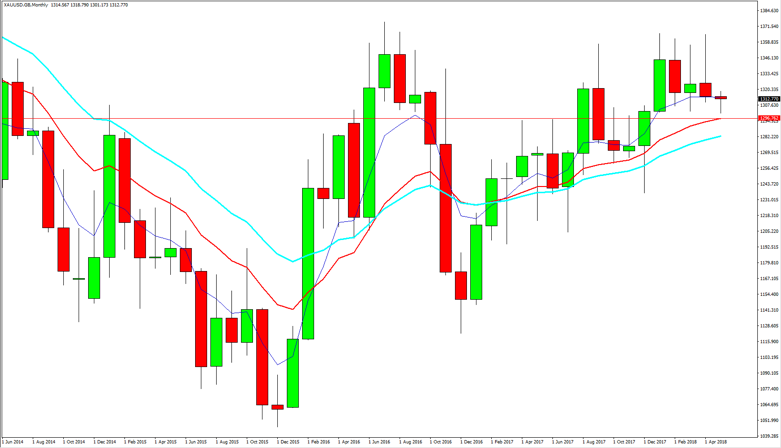

| Long term trend: Up (as defined by yearly Moving Averages) | ||

|

The nearest support level is now at USD1297 (13 period EMA) as gold prices continue to rise. | |

| NOTE: | In Non Trending Mode markets (aka range trading markets), CCI directional Indicators have statistically demonstrated a higher correlation to market direction. Additionally, we overlay the CCIs in a format that further reveals market cyclical structure and thus enhances market analysis. | |

COMMITMENT OF TRADERS REPORT (ANALYSIS)

Reportable positions as of 01 May 2018,

| Commitment of Traders Report | |||||||||

| Commercial | Non Commercial | ||||||||

| Producer/Merchant

/Processor/User |

Swap Dealers | Managed

Money |

Other

Reportables |

Non

Reportable Positions |

|||||

| Long | Short | Long | Short | Long | Short | Long | Short | Long | Short |

| 54,547 | 201,900 | 124,542 | 107,539 | 128,474 | 76,489 | 74,827 | 23,444 | 58,266 | 31,283 |

| Changes in commitments from 24 April 2018, | |||||||||

| -1,755 | -16,211 | 574 | -22,427 | -29,503 | 32,875 | 3,609 | -20,223 | 2,596 | 1,507 |

OUR TAKE:

Commercials increase their long positions by 54,547 contracts during the period of 24 April 2018 to 1 May 2018, while also increasing their short positions by 201,900 contracts during the same period.

(Focus is only on the Producer/Merchant/Processor/User as they are hedgers and Gold producers. Non-Commercials refer to CTAs and fund managers who trade (speculate) professionally. Commercial hedgers usually hold an edge over the speculators in the long run due to their “stronger hand” advantage and are usually reliable indicators of trend changes)

Call us at 6222 9703 or email at bullioninsights@goldsilvercentral.com.sg to discuss with us how to further interpret the data.

Preview of full Precious Metals Bullion Insights Report

To receive the full report of our Precious Metals Bullion Insights on the first working day of each week, please subscribe here:

(We promise there will be no spam but informative insights from our in-house technical analyst team!)

[gravityform id=”3″ title=”true” description=”true”]

PRECIOUS METALS MARKET REVIEW.

| Weekly Spot Price (14 August – 18 August 2017) | ||||

| Open | High | Low | Close | |

| Gold | 1289.85 | 1300.61 | 1267.06 | 1284.1 |

| Silver | 17.07 | 17.27 | 16.53 | 16.93 |

| Platinum | 984.08 | 987.81 | 950.43 | 976.58 |

Precious Metals News Updates:

| · | Gold trades little changed as investors focus on geopolitics, central bank meet. Gold prices were little changed on Monday as investors sought further direction after a week of geopolitical uncertainty in the United States and Europe and ahead of a meeting of central bankers later this week. | ||

| · | All that glitters is profit in China’s gold mines as demand for safe haven boost precious metal sales. Hedging demand triggered by political uncertainty became the main driver of the periodical increases in gold price. | ||

Economic figures to monitor this week:

| Day & Date | Economic Events |

| Wednesday, 23 August 2017 | ECB President Draghi Speaks

New Home Sales (Jul) (US) Crude Oil Inventories |

| Thursday, 24 August 2017 | GDP (QoQ) (Q2) (UK)

Existing Home Sales (Jul) (US) |

| Friday, 25 August 2017 | Core Durable Goods Orders (MoM) (Jul) (US)

Fed Chair Yellen Speaks |

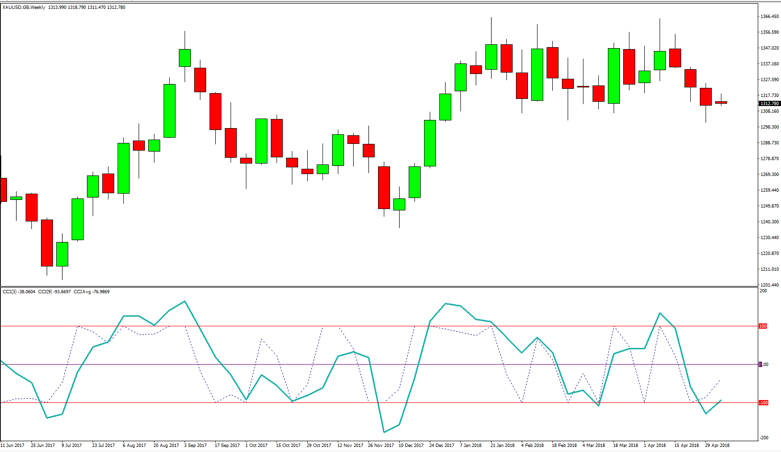

TECHNICAL ANALYSIS.

NOTE:

In Non-Trending Mode markets (aka range trading markets), CCI directional Indicators have statistically demonstrated a higher correlation to market direction. Additionally, we overlay the CCIs in a format that further reveals the market cyclical structure and thus enhances market analysis.

COMMITMENT OF TRADERS REPORT (ANALYSIS)

Reportable positions as of 15/8/2017,

| Commitment of Traders Report | |||||||||

| Commercial | Non Commercial | ||||||||

|

Producer/Merchant /Processor/User |

Swap Dealers | Managed

Money |

Other

Reportables |

Non Reportable Positions |

|||||

| Long | Short | Long | Short | Long | Short | Long | Short | Long | Short |

| 32,943 | 191,174 | 71,922 | 114,046 | 196,453 | 16,916 | 80,313 | 68,019 | 44,294 | 35,769 |

| Changes in commitments from 8/8/2017 | |||||||||

| -424 | +13,652 | -2,380 | +23,283 | +29,385 | -11,586 | +3,188 | +2,170 | -23 | +2,227 |

OUR TAKE:

Commercials continued to decrease their long positions while increasing their shorts positions by -424 contracts and 13,652 contracts respectively during the period of 8/8/2017 to 15/8/2017. Gold rallied 2% to reach the 1290 level, a level last seen in June. This is the first time in 4 weeks that Commercials increased their shorts position significantly. The last time this happened, Gold rallied as well.

(Focus is only on the Producer/Merchant/Processor/User as they are hedgers and Gold producers. Non Commercials refer to CTAs and fund managers who trade (speculate) professionally. Commercial hedgers usually hold an edge over the speculators in the long run due to their “stronger hand” advantage and are usually reliable indicators of trend changes)

Call us at 6222 9703 or email at bullioninsights@goldsilvercentral.com.sg to discuss with us how to further interpret the data.

PRECIOUS METALS MARKET REVIEW.

| Weekly Spot Price (19 June – 23 June 2017) | ||||

| Open | High | Low | Close | |

| Gold | 1253.62 | 1258.69 | 1240.65 | 1255.47 |

| Silver | 16.63 | 16.75 | 16.31 | 16.59 |

| Platinum | 926.15 | 933.83 | 915.9 | 926.43 |

| · | Gold Prices Weekly Forecast: Narrow Ranges Likely, Selling Interest On Rallies. Several US economic data release this week may suggest a decisive impact on sentiments surrounding the US economy, the Federal Reserve policy and Gold Prices. | ||

| · | Gold Plunges After 1.8 Million Ounces Were Traded in One Minute. Bullion sank at 9 a.m. in London on Monday after a huge spike in volume in New York futures that traders said may have been the result of a “fat finger,” or erroneous order. Trading jumped to 1.8 million ounces of gold in just a minute, an amount that’s bigger than the gold reserves of Finland. | ||

| · | Gold Miners (GDX) Setting Up For A Big Move Soon. Gold and especially gold mining stocks rebounded on Wednesday and trended higher into the weekend. This is giving some investors renewed hopes that the bull market that began roughly 18 months ago is about to reassert itself. | ||

| · | Economic figures to monitor this week: | ||

| Day & Date | Economic Events | ||

| Tuesday, 27 June 2017 | BoE Financial Stability Report (UK)

CB Consumer Confidence (Jun) |

||

| Wednesday, 28 June 2017 | Fed Chair Yellen Speaks (US)

Pending Home Sales (MoM) (May) (US) Crude Oil Inventories (US) |

||

| Thursday, 29 June 2017 | GDP (QoQ) (Q1) (US) | ||

| Friday, 30 June 2017 | Manufacturing PMI (Jun) (CHN)

GDP (QoQ) (Q1) (UK) |

||

Interested in our full free weekly Technical Analysis Report for Precious Metals?

Sign up here:

[gravityform id=”3″ title=”true” description=”true”]

PRECIOUS METALS MARKET REVIEW.

| Weekly Spot Price (5 June – 9 June 2017) | ||||

| Open | High | Low | Close | |

| Gold | 1279.66 | 1295.9 | 1264.38 | 1265.55 |

| Silver | 17.5 | 17.7 | 17.11 | 17.11 |

| Platinum | 952.84 | 967.18 | 933.86 | 935.5 |

Precious metals updates…

| · | Gold edges up on weaker stocks, dollar ahead of Fed meeting. Gold inched up on Monday as Asian stocks fell and the dollar eased ahead of a U.S. Federal Reserve policy meeting that could give clues on the pace of interest rate hikes over the rest of the year. | ||

| · | SHARPS PIXLEY Sees A 252 pct Increase In Physical Gold Demand. The elections leading to a hung parliament in the UK have seen a rush into physical gold by investors, as the country slips into a political vacuum. The uncertainty both in the UK and indeed geopolitical concerns across the globe have fed into firmer gold prices which have risen 11 pct so far in 2017 in international markets. | ||

| · | Economic figures to monitor this week: | ||

| Day & Date | Economic Events | ||

| Tuesday, 13 June 2017 | CPI (YoY) (May) (UK) PPI (MoM) (May) (US) |

||

| Wednesday, 14 June 2017 | Industrial Production (YoY) (May) (CHN) Claimant Count Change (May) (UK) Core CPI (MoM) (May) (US) Core Retail Sales (MoM) (May) (US) Crude Oil Inventories (US) |

||

| Thursday, 15 June 2017 | Fed Interest Rate Decision (US) BoE Interest Rate Decision (Jun) (UK) |

||

| Friday, 16 June 2017 | BoJ Monetary Policy Statement (YoY) (JPN) BoJ Interest Rate Decision (JPN) CPI (YoY) (May) (EUR) Building Permits (May) (US) |

||

Interested in our full free weekly Technical Analysis Report for Precious Metals?

Sign up here:

[gravityform id=”3″ title=”true” description=”true”]